Bank of America Favoring Black, Hispanic Homebuyers in Miami as DeSantis Stands Against ESG

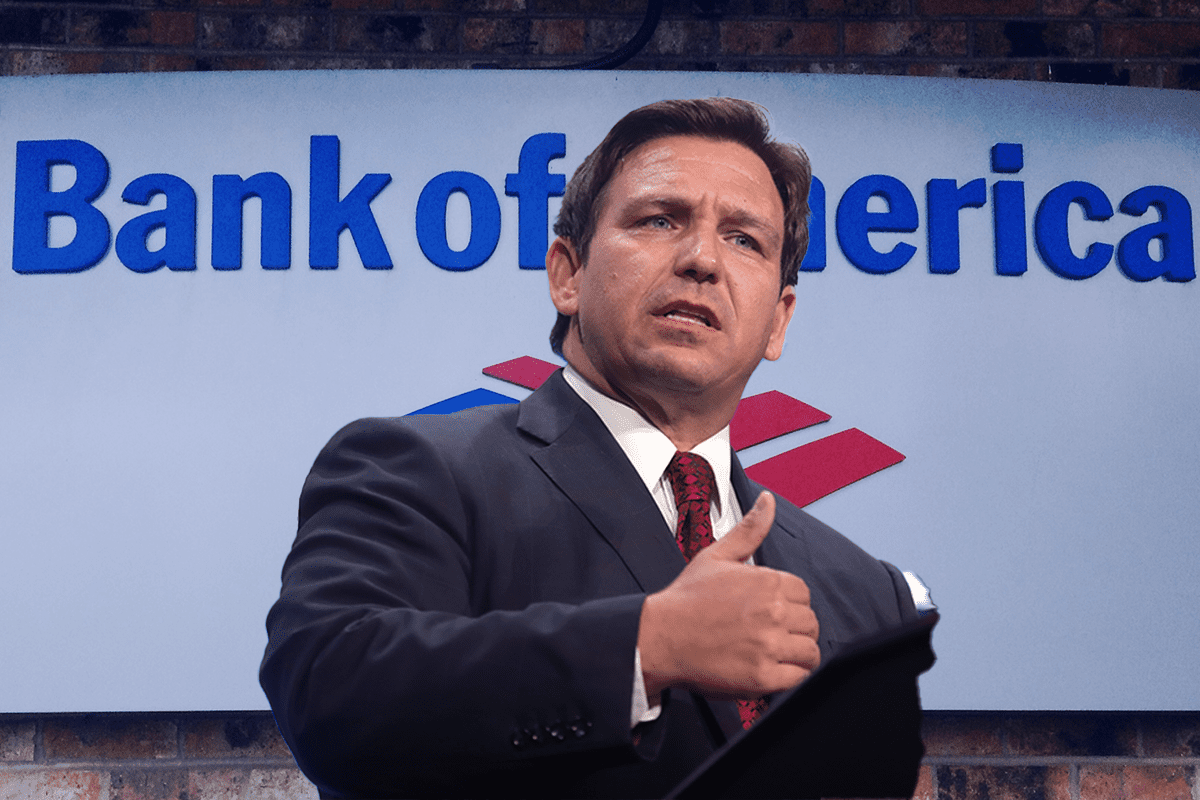

MIAMI (FLV) – Bank of America, the second largest bank in the U.S. at over $2.1 trillion in assets, announced they would be benefitting certain racially-categorized communities across the country with zero down payment and zero closing cost on mortgages for first-time homebuyers.

The banking giant said “designated markets” in “certain Black/African American and/or Hispanic-Latino neighborhoods” will be benefitted. Those cities are Charlotte, Dallas, Detroit, Los Angeles, and in Florida, Miami. It takes place under the “Community Affordable Loan Solution,” which aims to help buyers obtain an affordable loan for home-buying.

They say that their program comes after their existing “Community Homeownership Commitment,” which includes $15 billion in funding for affordable mortgages and other grants and education opportunities.

In a press release, Bank of America points to a “30-percentage-point gap” in homeownership between white and black Americans and a “20 percent” one for Hispanics. They say a “competitive housing market” has made it harder for these groups to purchase homes.

NBC News spoke with a Bank of America representative who said applicants do not have to be black or Hispanic to qualify for the program.

The representative said the program is meant to “make the dream of sustained homeownership attainable for more Black and Hispanic families, and it is part of our broader commitment to the communities that we serve.”

The program will reportedly require no minimum credit score or mortgage insurance. The bank will use factors such as “timely rent payments and on-time utility bill, phone and auto insurance payments.”

Environmental, Social, and Governance (ESG) scores are meant to measure a company’s “exposure to long-term environmental, social, and governance risks that are often overlooked during traditional financial analyses.” The ESG score is also promulgated by the World Economic Forum and Davos group.

On ESG, Bank of America has a dedicated webpage for the criteria, saying they are “driven by [their] commitment” to the principles of ESG.

“Driven by our commitment to responsible growth and guided by environmental, social and governance (ESG) factors, we continually strive to be open about our operations and the information and resources that shed light on our business,” they say. “Our environmental, social and governance (ESG) reporting presents pertinent information about the business of Bank of America in all 50 states, the District of Columbia, the U.S. Virgin Islands, Puerto Rico and more than 35 countries and across our eight lines of business.”

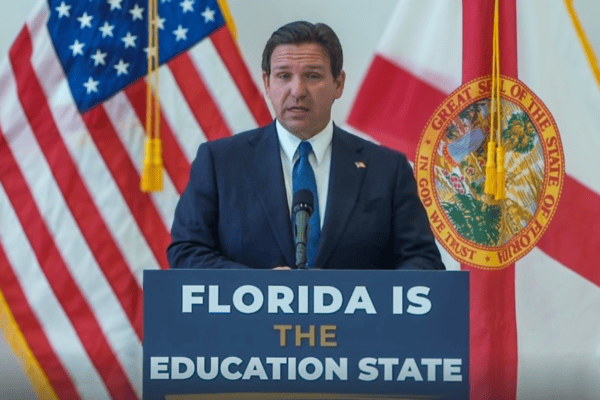

Gov. Ron DeSantis is a stark opponent to ESG scores, urging a bipartisan coalition of U.S. governors to use their “proxy voting rights” by banding together in serving as a check against the practice.

DeSantis announced new changes for the next legislative session to go after ESG criteria, including prohibiting the State Board of Administration fund managers from using political factors when determining where to invest the state’s money.

In Aug., DeSantis’ cabinet approved rules to prohibit political factors from being used to determine how the state funds should be invested Tuesday. “I think the movement that we’ve seen to harness economic power to try to advance an ideological agenda that doesn’t have enough appeal to win at the ballot box is something that is very significant,” Gov. Ron DeSantis said at the cabinet meeting.

Under the resolution, Florida’s fund managers will be required to invest state funds in a way that prioritizes the highest return on investment for Florida taxpayers instead of considering political factors. ESG factors will not be part of the Florida’s pension investment management practices.

“We’ve got a big pension. We’re an important player in this,” he said. “This is a very important step.”

DeSantis decries ESG’s tendency to allow the “most economically elite and powerful interests in society” to govern Americans. “I think our economy is going to be much better off if everything is not politicized. It used to be it wasn’t a political issue. You didn’t have to take positions on every little thing.”

“Now almost everything that’s being done, there’s a political overtone to it. You can’t run an economy effectively if that’s the case […] We want them to invest the state’s money for the best interests of the beneficiaries of those funds, which is again, the people that are retired cops and teachers and other public employees.”