Bill filed targeting bank discrimination, ESG in state investments

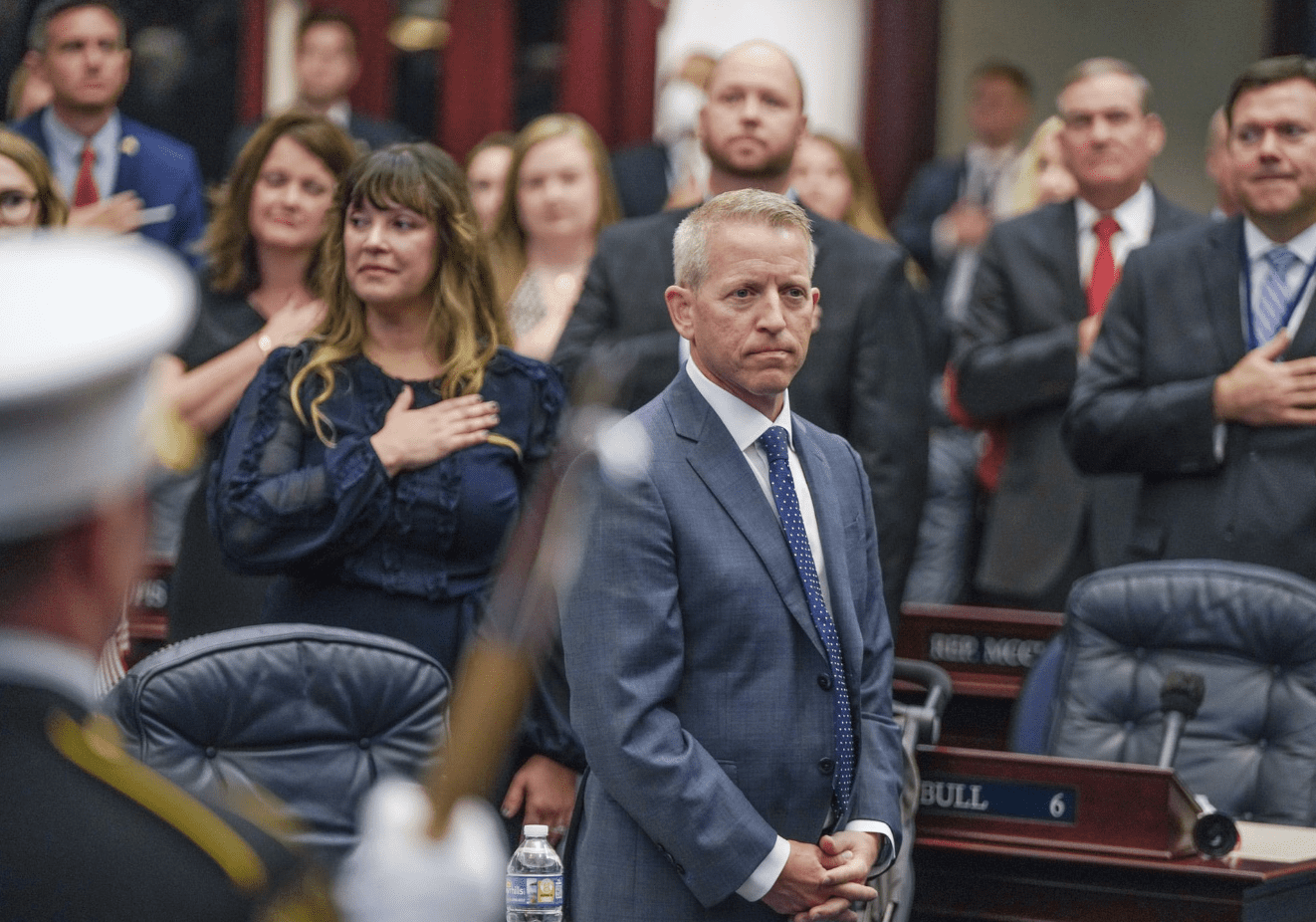

TALLAHASSEE, Fla. (FLV) – Florida House Speaker Paul Renner announced legislation to eliminate environmental, social, and governance (ESG) factors in state investments and prohibit banks from denying services based on someone’s political or religious beliefs.

“Florida’s investment decisions should be based solely on financial or pecuniary factors, not political virtue signaling through radical ESG investment strategies,” Renner said in a press release.

ESG – environmental, social, and governance – is a business framework that determines investment based on political factors such as renewable energy and social justice initiatives.

“When financial institutions use ESG to make investment decisions, they drive up the cost of living, undermine our national security, and bypass our democratic process,” Renner explained. “Those with the responsibility of investing state dollars, like state employee pension fund managers, have a primary fiduciary duty to act in the sole financial interest of their client and should not capitulate to the ESG demands of martini millionaires.”

The bill also requires local governments make investment decisions based only on “pecuniary factors,” and not make decisions based on other objects that include “sacrificing investment” to promote non-pecuniary factors.

“The weight given to any pecuniary factor must appropriately reflect a prudent assessment of its impact on risk or returns,” it said.

“We will protect our state’s fiscal health and retiree nest eggs from the radical ESG agenda by ensuring bond rating agencies and financial institutions focus on their fiduciary responsibilities and prevent Floridians from being discriminated against for personal beliefs,” bill sponsor Rep. Bob Rommel, R-Naples, said.

“I look forward to working with Speaker Renner and Governor DeSantis to fight back against corporate elites who threaten to hijack our democracy for their political gain.”

The bill explained that it prohibits banks from using “unsafe and unsound practices” of denying services based on a person’s political opinions, speech, religious beliefs, and factors in the person’s business sector.

“Unsafe and unsound practice” means the entity cannot use any rating, scoring, analysis, or action that considers a social credit score based on factors such as the person’s political opinions, religious beliefs, the person’s lawful ownership of a firearm, and the person’s support of the government combatting illegal immigration.

The bill does not prohibit banks that claim there was a religious purpose for making determinations based on religious beliefs.

“Through this legislation, we will protect the investments of Floridians and the ability of Floridians to participate in the economy,” Gov. Ron DeSantis said when the legislation was announced.

The governor’s office said the proposal is:

- Prohibiting big banks, trusts, and other financial institutions from discriminating against customers for their religious, political, or social beliefs — including their support for securing the border, owning a firearm, and increasing our energy independence.

- Prohibiting the financial sector from considering so called “Social Credit Scores” in banking and lending practices that aim to prevent Floridians from obtaining loans, lines of credit, and bank accounts.

- Prohibiting banks that engage in corporate activism from holding government funds as a Qualified Public Depository (QPD).

- Prohibiting the use of ESG in all investment decisions at the state and local level, ensuring that fund managers only consider financial factors that maximize the highest rate of return.

- Prohibiting all state and local entities, including direct support organizations, from considering, giving preference to, or requesting information about ESG as part of the procurement and contracting process.

- Prohibiting the use of ESG factors by state and local governments when issuing bonds, including a contract prohibition on rating agencies whose ESG ratings negatively impact the issuer’s bond ratings.

- Directing the Attorney General and Commissioner of Financial Regulation to enforce these provisions to the fullest extent of the law.

Senate President Kathleen Passidomo, R-Naples, applauded the governor and speaker for bringing awareness to ESG policies.

“We all want our state employees and local employees – including many classroom teachers and law enforcement officers who are part of the state retirement system – to have a strong retirement they can count on. Together, we are going to make certain that state funds are managed to prioritize the highest return on investment, as our retirees and taxpayers expect,” Passidomo said.

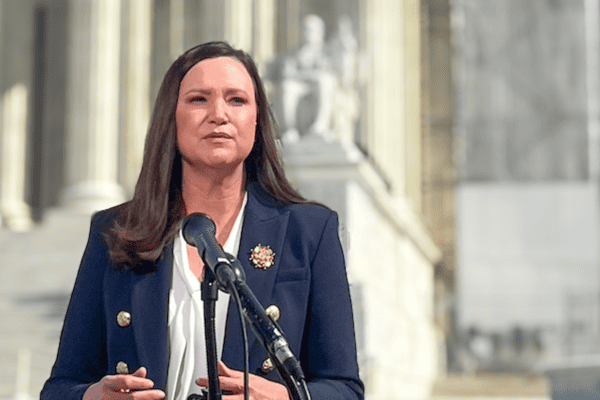

Sen. Erin Grall, R-Vero Beach, said ESG “poses a threat” to American families.

“People should be able to express their religious and political beliefs without fear of retaliation from the financial institutions they rely on for basic banking services. We must safeguard our state investments by focusing on the return on investment for taxpayers, not arbitrary guidelines determined by corporate activists,” Grall said.