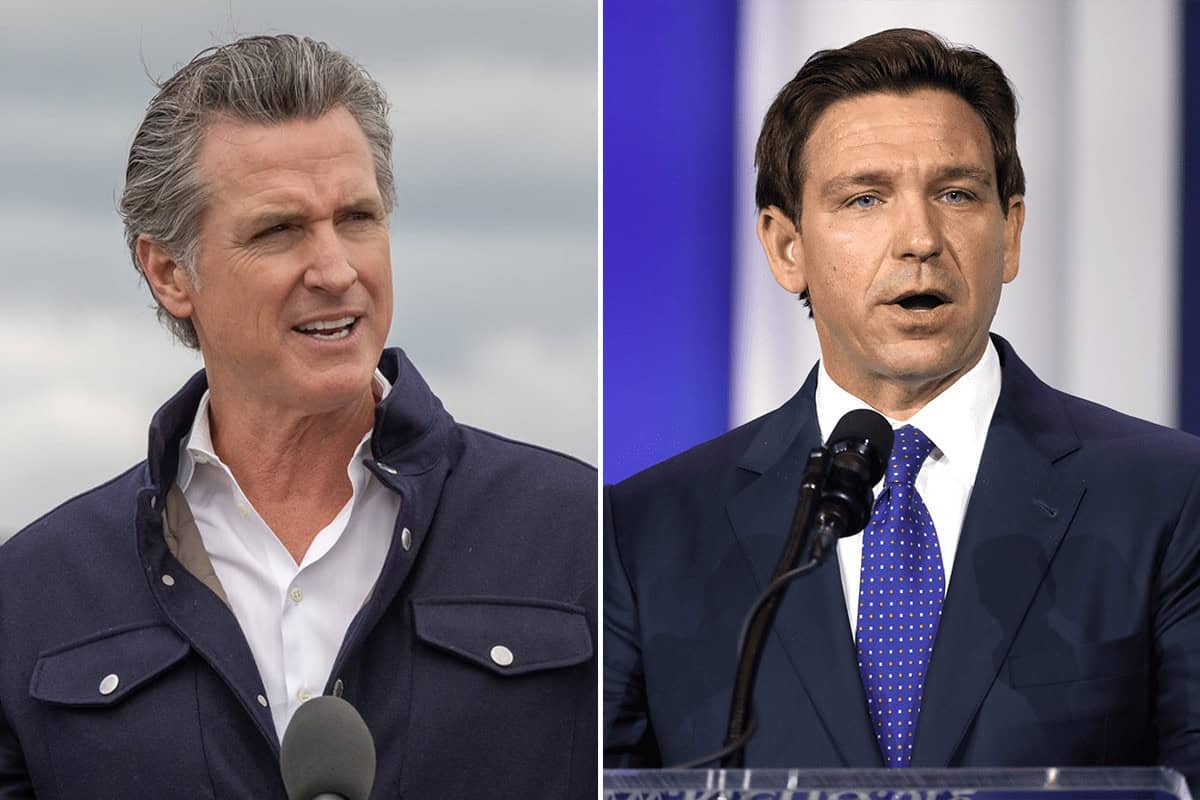

‘Choose wisely’: DeSantis official contrasts Florida’s continued tax relief with California

TALLAHASSEE, Fla. – Christina Pushaw, a member of Gov. Ron DeSantis’ executive office, highlighted the difference between Florida and California’s approach to tax policy.

The comment came after DeSantis announced over $1 billion in tax relief for Floridians in the upcoming fiscal year, while California’s Supreme Court announced it would be hearing oral arguments against a ballot initiative advocating for taxpayer protections.

“A tale of 2 states,” Pushaw said on social media. “Choose wisely.”

The Taxpayer Protection and Government Accountability Act is an initiative seeking to provide Californians more control over new taxation in the state.

It requires voter approval for any new or higher taxes that the state or local governments hope to approve.

The court agreed to hear arguments after Gov. Gavin Newsom and state Democratic leader expressed opposition to the initiative.

The initiative argued that Californians are overtaxed and that the overtaxation has caused increased poverty and unaffordable living conditions in the state. It was ultimately signed by nearly 1.1 million residents in California, far exceeding the required signatures needed for ballot access.

“California’s high cost of living not only contributes to the state’s skyrocketing rates of poverty and homelessness, they are the pushing working families and job-providing businesses out of the state,” the initiative read.

It mentioned how the state’s residents have repeatedly attempted to get a grip on the state’s taxation, but have failed to do so because of the elected politicians in office.

“In enacting this measure, the voters reassert their right to a voice and a vote on new and higher taxes by requiring any new or higher tax to be put before voters for approval,” it argued.

The Supreme Court is expected to hear the oral arguments on Wednesday.

Meanwhile, DeSantis announced on Tuesday that Floridians would be getting over $1 billion in tax relief thanks to various tax holidays and credits for individuals, families and businesses in the upcoming fiscal year.

The governor argued that, because of the state’s continued revenue surplus, it’s important to give back to Florida’s residents.