DeSantis’ Office Rebukes Property Insurance Critics, Points to Chaotic History and Optimism for Lasting Reform

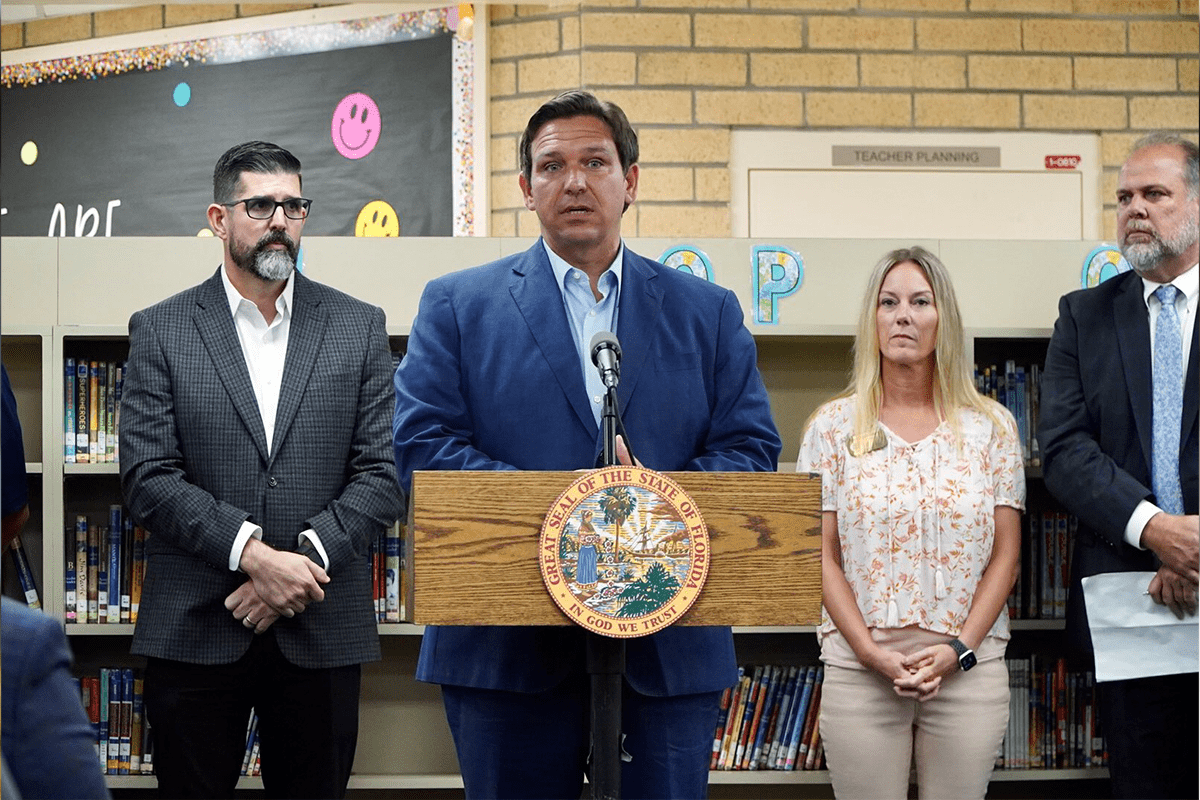

TALLAHASSEE (FLV) – As Democrat opponents of Gov. Ron DeSantis use a tumultuous property insurance market to attack the incumbent Republican, especially in the wake of Hurricane Ian, the administration rebuked critics who blame the market’s faults on DeSantis alone.

The Palm Beach Post, Florida Politics, and the Financial Times are among media outlets amplifying the criticism from Democrats. Charlie Crist, the Democrat running to unseat DeSantis, asked Ian victims for campaign donations when asking them to share their story of losing coverage “because of Ron DeSantis’s property insurance crisis.”

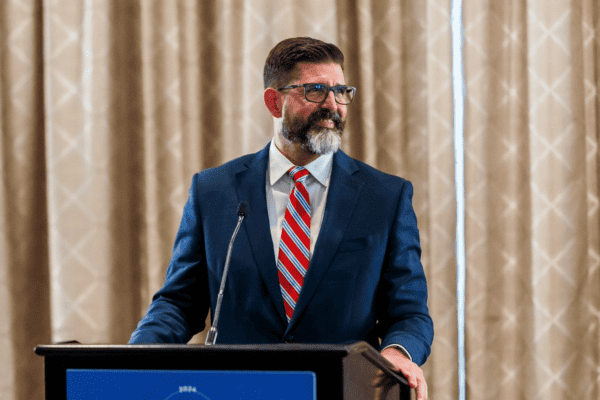

Bryan Griffin, the press secretary for the governor, told Florida’s Voice that the premise of DeSantis causing and allowing the property insurance market’s downfalls negates the years of “bad public policy” well before his tenure. He pointed to landmark reforms instituted in the last couple legislative sessions.

“Florida’s property insurance market has been chaotic since 2007, when bad public policy forced insurers to flee Florida, and the state’s insurer of last resort, Citizens, ballooned,” he said. Citizens was designed to be an “insurer of last resort” and now has over one million customers.

“Since 2007, the main cost driver has been excessive litigation.” In 2007, Charlie Crist became governor as a Republican.

The Sun Sentinel in 2008 acknowledged new reforms under Crist’s watch did not do what was promised:

The “reforms” have failed to achieve lasting rate reductions, and they have led many private insurers to reduce or eliminate their exposure to Florida’s daunting risks.

The Sun Sentinel

In 2019, while 8.6% of property insurance clams in the U.S. were filed in Florida, 76.45% of property insurance litigation in the country occurred in Florida, he explained.

The governor’s office pointed to reforms passed in the Florida legislature, and signed by DeSantis, in 2021 and 2022.

During the 2021 legislative session, DeSantis signed SB 76, which aimed to reform elements of the litigation environment. The changes were to “take potentially two years to feel the impact,” Griffin said, because pending litigation and insurance claims before its effective date are not changed by the new law.

The governor’s office is optimistic for the market while acknowledging ongoing challenges from litigation stemming from Hurricane Irma and other storms. They touted DeSantis’ appointment of over 100 judges and 5 Florida Supreme Court justices who “have reduced frivolous litigation.”

In late May, DeSantis’ special session yearned to tackle the issue of property insurance resulted in SB 2D, which enacted “the most robust and significant reforms Florida has seen in decades to combat skyrocketing insurance costs”:

- $2 billion in reinsurance relief through the Reinsurance to Assist Policy (RAP) program to benefit policyholders over the next two years

- Requiring insurance companies to file a supplemental rate filing once enrolled in the program to provide relief to policyholders

- $150 million for the My Safe Florida Home Program to provide grants to Florida homeowners for hurricane retrofitting, making homes safer and more resistan to hurricane damage, which can result in premium discounts for those participating in the program.

- Prohibiting insurance companies from denying coverage based solely on the age of a roof if the roof is less than 15 years old or if the roof is determined to have at least five years of useful life remaining

- Requiring insurance companies to provide policyholders with a reasonable explanation if they deny or partially deny a claim and provide consumers more access to information during the claim adjustment process

- Creating a new standard for applying attorney fee multipliers, which were previously liberally applied and resulted in increased costs to consumers

- Limiting the assignment of attorney’s fees in property insurance cases, disincentivizing frivolous claims

In May 2022, DeSantis celebrated the special session legislation, saying the reforms “will help stabilize a problematic market, help Floridians harden their homes through the My Safe Florida Home Program, and pave the way for more choices for homeowners.”

On the May reforms, Chief Financial Officer Jimmy Patronis applauded the legislature for its proposals: “I applaud the Legislature for proposing to expand and bolster the Home Hardening priority through the $150 million My Safe Florida Home proposal.”

The governor’s office said they collaborated with the Florida Office of Insurance Regulation, Citizens, the Florida Insurance Guaranty Association, and the Chief Financial Officer to prevent insurers from leaving the state. In July, the OIR announced a new arrangement for insurers “facing potential financial instability rating downgrades.”

“Even the most aggressive reforms will take time to affect the insurance industry,” Griffin explained. “The 2021 and 2022 legislative efforts will be effective. The Governor expects the legislature to continue its work and pass reforms that will stabilize the property insurance market further and ensure that Floridians have ample options for affordable property insurance coverage.”

In the wake of Ian, DeSantis said he plans to call a special session of the legislature by the end of the year for property owners to receive rebates on their property taxes. “We want to make sure that we’re doing all we can to clear the burdens that folks are dealing with when it comes to recovering from this storm,” he said.

The governor said he spoke with incoming House and Senate leadership: “They are eager to come back to be able to make this relief permanent for victims of Hurricane Ian and particularly those who had a total loss of their home or of their business.”

Monday, Oct. 22, DeSantis announced more support for Ian-impacted homeowners, awarding $5 million to local housing partners to help Floridians pay home insurance deductibles in six counties. “Following the impacts of Hurricane Ian, it was really important to us to make sure people were able to get back into their homes and rebuild as quickly as possible – today’s announcement will help do just that,” he said. “We know a lot of homeowners had coverage for the storm, however insurance deductibles are expensive and often a gap not covered by other support. These funds will immediately help families and seniors with limited means get closer to recovery.”

Florida is a high-risk state for insurance providers, especially because of the likelihood of hurricanes and floods. The CEO of state-backed Citizens said premiums will likely spike again in light of more than half a million claims being filed after Hurricane Ian battered the Sunshine State.

CEO Barry Gilway said Citizens is “very, very well funded for this storm [Ian].”

DeSantis previously touched on Citizens amidst Ian, saying it is “unfortunately undercapitalized.” Gilway said the governor is correct: “We’re undercapitalized, I mean, there’s no question about it. The Personal Lines Account, this storm will eliminate all the surplus that we have.”

Legislative reforms coming later in 2022 in a special session called by DeSantis would aim to continue to address and remedy the market. State Rep. Fentrice Driskell, D-Tampa, reacted to DeSantis’ expressing a desire for more reform, falsely claiming he previously failed to act: “We’re glad Governor DeSantis is finally on board with what Florida Democrats have been saying the whole time: our property insurance market is in crisis and Floridians are suffering. I’m just sorry it took a hurricane to get him to act.”