DeSantis Signs Bills to Combat High Insurance Rates and Provide Condo Safety Checks

May 27, 2022 Updated 9:05 A.M. ET

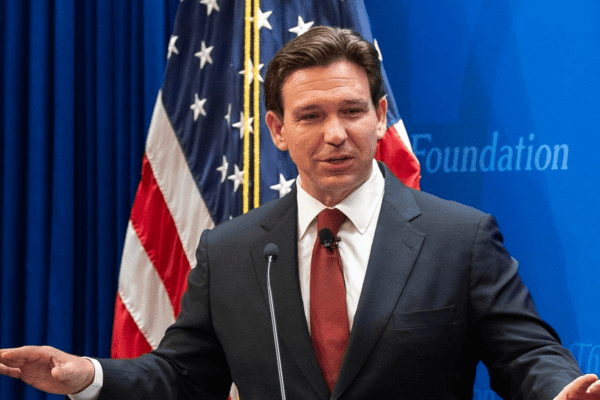

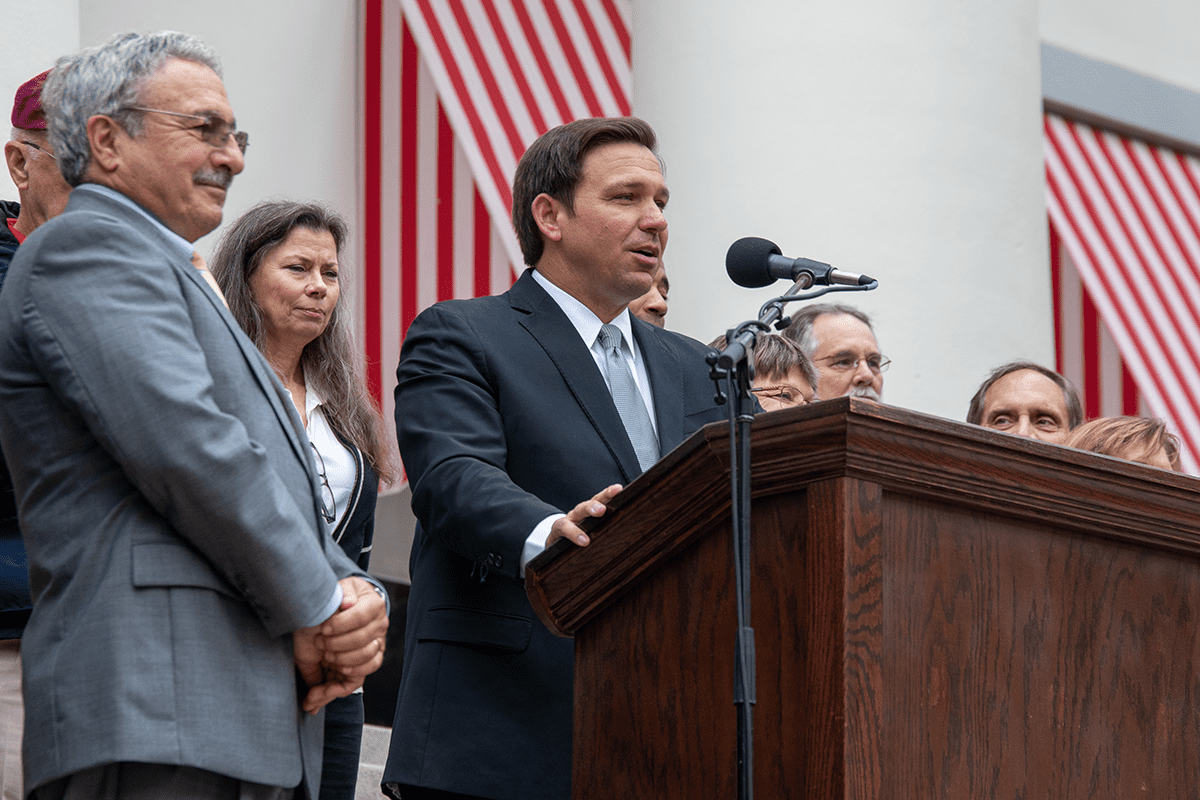

TALLAHASSEE (FLV) – Gov. Ron DeSantis Thursday signed bills that aim to lower property insurance rates for Floridians. He also signed legislation to help prevent building collapses like the one in Surfside last year.

The bills to stabilize the property insurance market come during a time when insurance rates are skyrocketing and insurance companies are fleeing the state.

“This package represents the most significant reforms to Florida’s homeowners insurance market in a generation,” DeSantis said. “These bills will help stabilize a problematic market, help Floridians harden their homes through the My Safe Florida Home Program, and pave the way for more choices for homeowners.”

Republicans said the legislation will protect consumers, hold companies accountable, and reduce frivolous lawsuits. Homeowners are not expected to see significant relief for 12 to 18 months.

Under the law, taxpayer dollars would fund $2 billion into a fund for insurance companies to tap into, which should ultimately lower some rates for Floridians.

Republican State Sen. Jim Boyd said in 2021 76% of the lawsuits in the country were filed in Florida but 7% of claims were filed in Florida. Boyd said frivolous lawsuits are part of the reason why insurers are going bankrupt and avoiding business in Florida leaving Floridians with few insurance options.

The law also provides $150 million to start up the My Safe Florida Home program. The program will provide homeowners with grants for hurricane retrofitting and will provide premium discounts.

The new condominium bill DeSantis signed will require more inspections. It requires condominium associations and cooperative associations to have a “milestone inspection” performed for buildings that are three stories or taller by the end of the year once that building reaches 30 years old and every ten years following.

If the building is located within three miles of a coastline, it must have a “milestone inspection” performed by December 31st once the building reaches 25 years of age and every ten years after that.

Read more about the condominium law here. Read more about the property insurance reform law here.