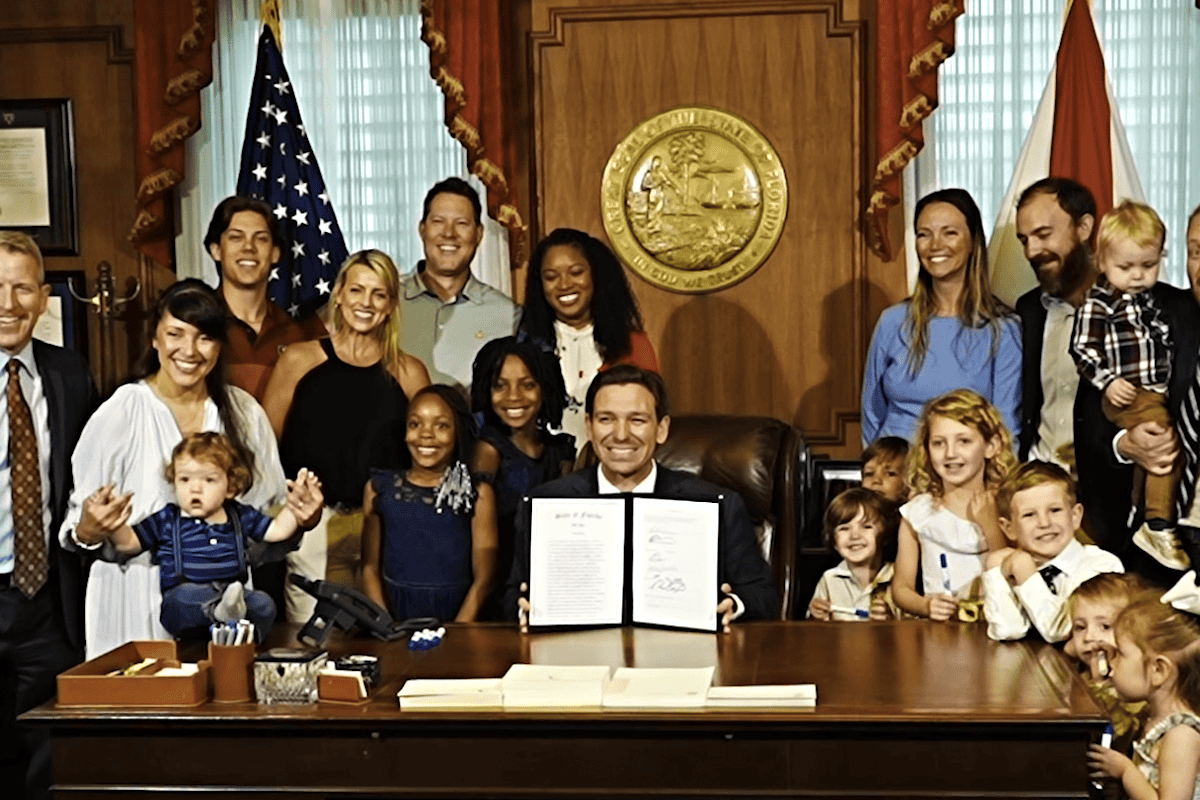

DeSantis signs tax relief package bringing total to $2.7 billion

TALLAHASSEE, Fla. (FLV) – Gov. Ron DeSantis signed a $1.3 billion tax relief package into law Thursday, which brings the total for the fiscal year up to $2.7 billion in savings.

With other housing initiatives and the toll relief program, the DeSantis administration noted their initiatives totaled a record $2.7 billion.

The governor’s office called it the largest tax relief plan in Florida’s history, which includes a permanent tax exemption for baby and toddler items such as diapers.

“Because of President Biden’s disastrous economic policies, Florida families are feeling the pressure of inflation on their wallets,” DeSantis said. “But in Florida we are ensuring that our state’s economic success gets passed on to the people that made it possible.”

There are two back-to-school tax holidays and two disaster preparedness sales tax holidays that last 14 days each. Another freedom summer sales tax holiday on recreational items and children’s toys will begin Memorial Day until Labor Day.

“I will continue to push smart fiscal policy that will allow Florida families to keep more of their hard-earned money in their pockets,” DeSantis said. “Stronger families make a stronger Florida.”

The governor’s office said it will save Florida families $234 million.

Other items permanently exempt from sales tax will include oral hygiene products like toothbrushes and toothpaste and firearm safety devices.

“The dysfunction in DC has trickled down to Florida’s families who are left to deal with an unsustainable affordability crisis. I am proud of how our members came together to identify critical areas of need to make Florida a more affordable place to live,” House Speaker Paul Renner, R-Palm Coast, said.

It includes a one-year sales tax exemption on gas stoves and Energy Star appliances.

“Governor DeSantis laid out an ambitious plan to provide Florida families with much needed relief. Thanks to his leadership, along with Speaker Renner and our partners in the Senate, we delivered over $1 billion dollars in tax relief, helping Floridians keep more of their hard-earned money,” Rep. Stan McClain, R-Ocala, said.

Senate Minority Leader Lauren Book, D-Davie, said essential health and hygiene items should not be taxed.

“This was an incredible start — but we knew we needed to do more to provide permanent relief — not only for those families with young children, but to also ensure incontinence products for people of all ages are included, too,” Book said.

Sales tax holidays included in the tax relief package for the 2023–2024 fiscal year:

- Back-to-School sales tax holidays will take place July 24 – August 6, 2023, and January 1 – January 14, 2024.

- Disaster Preparedness sales tax holidays will take place May 27 – June 9, 2023, and August 26 – September 8, 2023.

- The Freedom Summer sales tax holiday lasts from Memorial Day through Labor Day of this year.

- The Tools and Equipment sales tax holiday will take place from September 2 – September 8, 2023.