Florida battles federal policy that may raise 80% of Floridians’ flood insurance costs

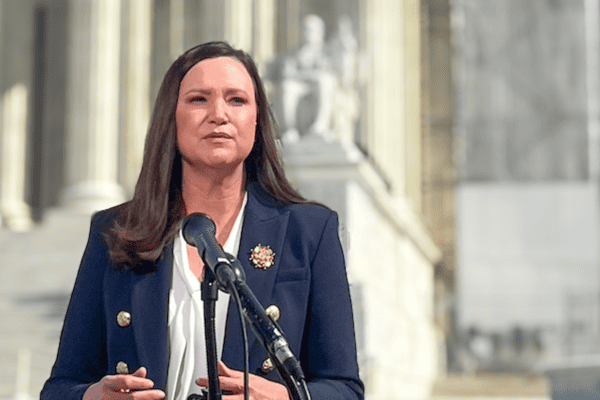

TALLAHASSEE, Fla. (FLV) – Florida Attorney General Ashley Moody joined legal action with other states against the Biden administration over a new federal policy that could raise 80% of Floridians’ flood insurance rates.

A legal complaint was filed over FEMA’s new “Equity in Action” methodology on determining the National Flood Insurance Program’s pricing, which took effect April 1.

According to the complaint, the new methodology “fundamentally” changes how federal flood insurance rates are calculated.

“Under Risk Rating 2.0—Equity in Action (‘Equity in Action’), the agency ignores historical observed flood events in favor of future flood hypotheticals to determine the present flood risk of each insured property,” it said.

The attorney general’s office argued that the new “equity” plan makes flood insurance “unattainable,” thus going against “congressional mandates” that the National Flood Insurance Program give “affordable” coverage.

Moody’s office noted that in Florida, 76% of residents live in coastal areas that are prone to flooding, with around half living in zones that require insurance.

They warned 80% of policy premiums will increase because of the new FEMA policy.

“The Equity in Action methodology does not take into account any mitigation efforts a community does in calculating premium costs—raising insurance costs for Floridians,” Moody’s office said.

Florida joined Idaho, Kentucky, Louisiana, Mississippi, Montana, North Dakota, South Carolina, Texas and Virginia in the complaint.