Florida insurance commissioner confident DeSantis’ budget will improve costs

TALLAHASSEE, Fla. – Florida Insurance Commissioner Michael Yaworsky said Wednesday that Gov. Ron DeSantis’ 2024-2025 budget proposal will help the insurance market.

“Governor DeSantis’ budget recommendations demonstrate an ongoing commitment to Florida’s policyholders by providing the Florida Office of Insurance Regulation (OIR) with the necessary resources to regulate one of the most complex insurance markets in the world,” Yaworsky said.

The budget totals $114.5 billion and includes nearly $500 million for homeowners insurance.

“We will continue to provide big tax relief,” DeSantis said during a press briefing on Tuesday. “This budget provides more than $1.1 billion in tax relief, including a new tax relief initiative, $431 million to reduce the cost of homeowners insurance.”

The Florida Office of Insurance Regulation noted that of the $431 million proposed by the governor, $409 million goes towards one-year exemptions on taxes, fees or assessments for residential property insurance holders.

The remaining $22 million would go towards a “permanent insurance premium tax exemption” for flood insurance.

“Governor DeSantis’ Focus on Florida’s Future budget will ensure OIR can remain focused on protecting consumers and fostering an insurance market where insurance products are reliable, available and affordable for Floridians,” he said.

Also in the budget is a recurring $107 million for the My Safe Florida Home program, which helps homeowners with home inspections and home hardening.

Additional funding proposed by DeSantis goes towards research and analysis on how to lower insurance premiums further.

The funding for homeowners insurance comes on top of a total of more than $1 billion for tax relief.

“We’re also going to continue with $170 million in small business tax cuts,” DeSantis said. “I don’t think there’s ever been, before I was governor, a billion dollars or more in tax relief in a given year. We did way more than that this year and of course we’re going to do the $1.1 billion going forward.”

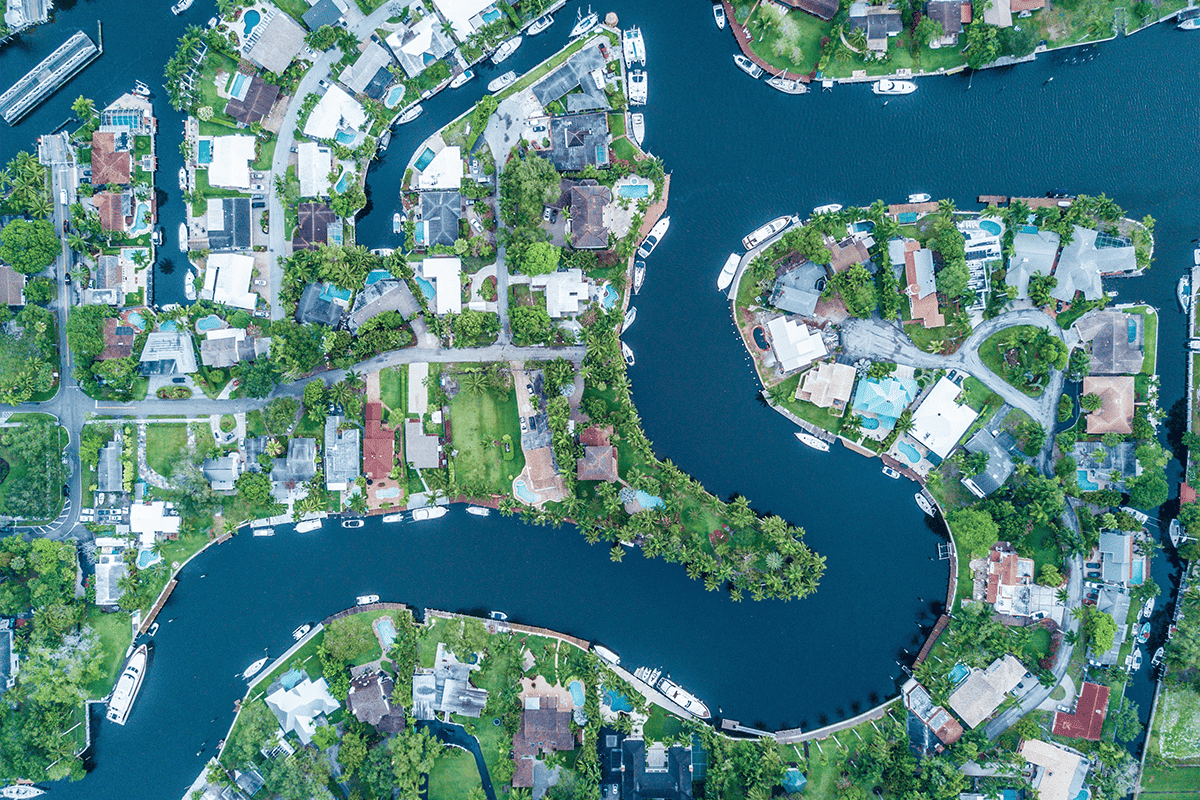

The governor and Florida lawmakers have been making an effort to improve Florida’s tumultuous insurance market, which is rid with high rates of litigation and high costs.

In 2023, the state has approved more property insurance companies into the market.

DeSantis also signed three pieces of legislation in June that aimed to help the situation.

And late last year, the governor also signed a new law after a special session that vied to stabilize Florida’s insurance market. Republican Reps. Tom Leek and Bob Rommel sponsored the bill in the House. Republican Sen. Jim Boyd sponsored the bill in the Senate.