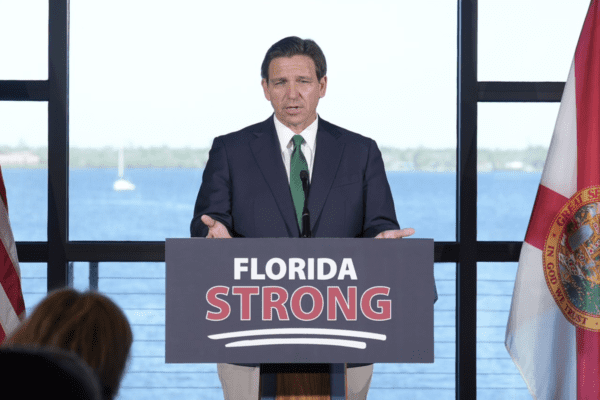

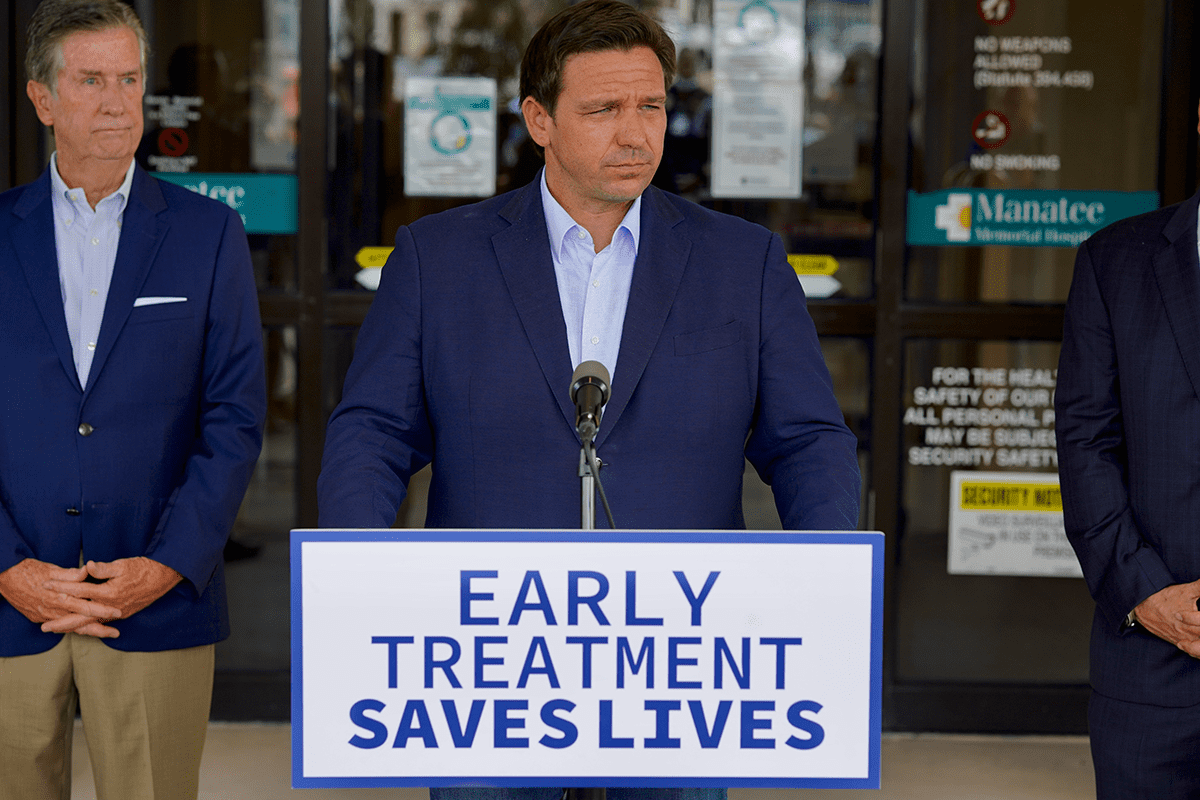

Florida Lawmakers Send Sweeping Property Insurance Reform to Governor DeSantis’ Desk

May 25, 2022 Updated 3:15 P.M. ET

TALLAHASSEE (FLV) – Florida lawmakers approved a sweeping property insurance reform bill Wednesday that aims to address homeowners’ premium rates that are soaring through the ceilings.

The Florida House of Representatives approved the bill 95 to 14 Wednesday. The bill will now move to Gov. Ron DeSantis’ desk.

Republicans said the legislation will protect consumers, hold companies accountable, and reduce frivolous lawsuits.

Many Republicans and Democrats said this bill is a “first step” to lower rates and help bring insurance companies back to the state.

“They are on life support. They barely have a heartbeat,” said Republican Rep. Bob Rummel said in support of the bill. “We need options. We need to have a bill that will take away the fear of the legal climate so that more companies and more capital will come to the state of Florida and that’s what’s going to help stabilize rates.”

Homeowners are not expected to see significant relief for 12 to 18 months. Democrats expressed concerns that consumers will not experience significant relief from rising premium rates until that time.

“They need help and this bill isn’t giving it to them,” Democrat State Rep. Michael Grieco said.

Many lawmakers voted for the bill knowing that future steps would still need to be taken.

“I don’t think unfortunately that our constituents are going to see the results that they want to see right away, but I do think that this is an important first step for us to take, but it can’t be the last step,” said Democratic State Rep. Fentrice Driskell.

Republican State Rep. James Vernon Mooney said this is a “good bill” and “worthy” of lawmakers voting in support.

“There is no perfect bill but let’s face it, this bill is better than doing nothing,” Mooney said. “We have to do something and the stabilization of the market will allow us to then move forward to discuss other issues.”

House bill sponsor Republican Rep. Jay Trumbull said consumers should feel some bit of relief once insurance companies can tap into the Reinsurance to Assist Policyholders fund (RAP). The RAP program provides insurance for the insurance companies. Trumbull said the skyrocketing reinsurance rates are one reason for higher premiums.

Under the bill, taxpayer dollars would fund $2 billion into RAP for insurance companies. Insurance companies tapping into the fund would be required to reduce their policyholders’ rates by June 30th of 2022 to reflect the savings from this reinsurance program.

Another major portion of the legislation aims to crack down on those frivolous lawsuits.

Republican State Senator Jim Boyd said in 2021 76% of the lawsuits in the country were filed in Florida but 7% of claims were filed in Florida. Boyd said frivolous lawsuits are part of the reason why insurers are going bankrupt and avoiding business in Florida leaving Floridians with few insurance options.

“It is insurance fraud for a contractor to deceptively waive, refund or pay a deductible,” Boyd said Tuesday. “And it’s also insurance fraud to intentionally file an insurance claim containing false fraudulent or misleading information.”

It would be a third-degree felony to intentionally file an insurance claim that has false, fraudulent, or misleading information.

The legislation also allows property insurers to include in the policy a separate roof deductible of up to 2% of the Coverage A limit of the policy or 50% of the cost to replace the roof. Essentially, if consumers chose to pay a higher deductible, the idea is their premium rate would decrease. This is not a mandate on the insurance company to provide the option or for the consumer to accept it.

The legislation also provides $150 million to start up the My Safe Florida Home program. The program will provide homeowners with grants for hurricane retrofitting and will provide premium discounts.

Insurance companies would also be banned from denying coverage based on the age of a roof that is less than 15 years old. Insurance companies could not deny claims without sufficiently communicating a reason. Consumers would be able to more easily access information and records during the claim adjustment process.