Tax relief on the way for Floridians pending DeSantis signature

TALLAHASSEE, Fla. – The Florida Legislature passed a sweeping piece of legislation providing for tax credits and exemptions for various items and expenses.

The most significant exemptions include no sales tax on back-to-school items including certain clothing, school supplies, learning aids and puzzles, and personal computers from July 29, through Aug. 11, 2024.

Additionally Disaster Preparedness items and supplies would be tax exempt from June 1, through June 14, 2024, and from Aug. 24, through Sep. 6, 2024.

Other exemptions for boating and water activity supplies, camping supplies and tools and safety equipment will also be tax exempt during certain parts of the year.

The bill also establishes other exemption and credits related to property taxes, corporate income taxes, insurance premium taxes and more.

The legislation, SB 7074, was sponsored by Rep. Stan McClain, R-Ocala.

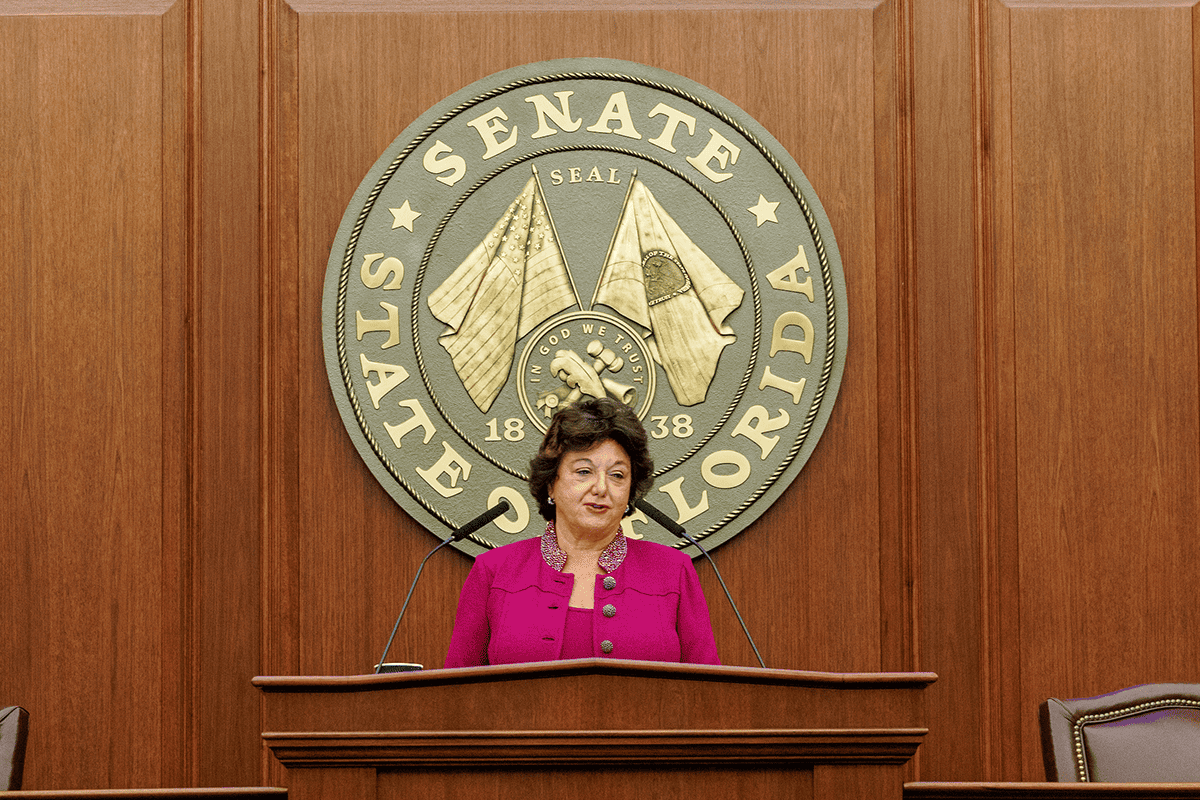

Sen. Blaise Ingoglia introduced a delete-all amendment when the Senate passed the House bill, expanding the legislation for even more credits and exemptions.

The taxation legislation passed the Senate 38-0 and the House 110-0.

The legislature passed multiple sales tax holidays for similar items in 2023.