Floridians continue to see property insurance increases: ‘We’re heading for a train wreck’

HOLLYWOOD, Fla. – As the property insurance crisis continues to affect Floridians, some business owners have reported skyrocketing insurance costs along with the shutdown of some assisted living facilities.

Filicia Porter, CEO of the House of Cares, an assisted living facility with two locations in Port St. Lucie and West Palm Beach, recently faced the difficult decision to shut down her business.

Porter told Florida’s Voice the soaring property insurance premiums were a “huge factor” in her decision.

Recent reports from the state suggest signs of stabilization in the insurance market, however, Porter stated that she had yet to see any improvements.

“I’ve been living here for 20 years… and I’ve been hearing that for 20 years,” she said.

She described the additional hurdles imposed by insurers, including what she calls “stringent” requirements and increased paperwork, which made securing “reasonable” insurance coverage increasingly challenging.

“In order to get a decent quote, you have to devalue your property,” she said, noting that some of the insurance quotes she received “almost tripled.”

Despite the closure of her businesses, Felicia ensured that none of her residents were displaced, allowing them to live out their stays until their passing.

Porter believes lawmakers are spending money on costs that are “completely unnecessary.”

“We need to start revisiting what is important, and where our dollar needs to be allocated,” she said. “When it comes to insurance, everybody needs protection.”

Larry Sherberg, owner of Lincoln Manor, a large assisted living community in Hollywood, told Florida’s Voice his insurance premiums rose dramatically in the last year.

Sherberg said his property insurance premiums rose from $20,000 in 2023 to a staggering $65,000 in 2024 and he had to make “significant changes” to the way his property is insured.

“It’s just horrible,” Sherberg said, describing his experience as “shellshock.”

“In theory, it’s putting us out of business, because that’s just my property [insurance], that’s not including my liability insurance,” Sherberg said.

In addition, Sherberg also reported other increases in costs, such as food, staffing, and ancillary supplies.

“It’s gone crazy. All we could do is watch how we spend our money so that our residents can still get the benefits and the care they need,” Sherberg said.

Shelagh Grubb, FALA associate board member and sales associate with Plastridge Insurance Agency, told Florida’s Voice her agency has seen 5-10% of their insured facilities shutting or deciding to sell their business.

“In the last year, I would say about 20-25 have sold,” Grubb said.

“Their heart is still in it, but they’re just tired. They’re getting hit from every angle. It’s affecting their life at this point […] They’re worried about getting sued. They’re worried about how they’re going to pay their bills,” Grubb said.

Last year, Grubb said some of the rate increases she saw were 50% to 100% [on average per person]. This year, they have seen additional increases “anywhere from 10% to 50% – on average.”

Grubb described the emotional experience writing policies and delivering the news of increased rates to those who run assisted living facilities.

“I’ve had people cry, I’ve had people just… I let them vent to me because I’ll do anything I can for these people,” Grubb said.

Grubb said her clients are “some of the most resilient, hardworking people with the biggest hearts I’ve ever seen in my life.”

The property insurance crisis also greatly affects facilities that take Medicaid, Grubb added.

“These people are on fixed income – it’s not like they can just increase the room rates in a lot of cases, like they get what they get,” Grubb said.

“It’s just tough out there. I blame all parties because it was handled poorly everywhere and now it’s not just the assisted living facilities, it’s the state of Florida,” Grubb said. “The rates are just bad.”

Grubb said she believes Florida lawmakers passed “a lot of really good bills,” such as Senate Bill 2A which reportedly aimed to make “sweeping changes to the property insurance claims process” in Dec. 2022. She noted that officials said it would take around two years to see the “benefits of it.”

Luis Collazo, who manages Palm Breeze Assisted Living Facility in Hialeah, told Florida’s Voice he has seen a “dramatic increase in costs across the board.”

Collazo said at his building, they have seen over a 50% increase in insurance costs [property and liability] over the past three years and over the past six years they saw a 60-70% jump.

As the immediate past president of the Florida Assisted Living Association and a Miami Lakes councilmember, Collazo shared insights into the challenges at his building.

“Property insurance rates, along with liability insurance rates, are just through the roof,” Collazo said.

When it comes to facilities that operate with Medicaid resources, Collazo told Florida’s Voice any increase in operational costs, such as property insurance, can “erode” the services they are able to provide.

“If my operational costs go up disproportionately, to what the cost of living, or whatever adjustments are within the Medicaid system, at the end of the day, it impacts care,” Collazo said.

Rather than paying more for property taxes, Collazo would prefer to provide “better services” to his residents.

Collazo hopes lawmakers will tune into this issue and “get creative” with solutions.

“I think there’s ways that lawmakers can maybe take into consideration the most vulnerable in the state of Florida – if that’s through property tax relief – if that’s through incentivizing the marketplace to come back in, I think you have to get creative with what those solutions are,” Collazo said.

As the OIR reported a “downward trend” in property insurance rates, Florida’s Chief Financial Officer Jimmy Patronis said Florida’s insurance market is “improving day by day.”

However, despite these findings, Collazo noted that this decrease in rates hasn’t “trickled down to me, as the consumer – yet.”

Pilar Carvajal, founder and CEO of Innovation Senior Living, told Florida’s Voice that the property insurance crisis is “very concerning.” Carvajal has been in the assisted living industry for over 20 years and started her own business in 2016, which now has six properties.

“It’s really a train wreck… we’re heading into a train wreck at this point,” Carvajal said.

In the past five years, Carvajal said her company has experienced property insurance costs jumping “at least 50%.”

Carvajal emphasized the urgent need for politicians to address the property insurance crisis, warning that without intervention, businesses may be forced to either leave the state or cease operations altogether.

“I think that that’s where they [politicians] need to focus their attention. I’m not quite sure what the solution is, but increased premiums, and property insurance are not going to be sustainable for my business and others that need to be insured in this way,” Carvajal said.

“Sitting here and waiting to see what happens is not going to work,” Carvajal said.

Carvajal said she does not “see a real clear path to a resolution, considering things I think are just going to go and get more difficult in the state as it relates to weather.”

Florida’s Voice previously reported NOAA released its Atlantic hurricane activity forecast, which is reportedly the most aggressive “on record.”

“If we’re having more and more hurricanes in the future, I don’t know how property insurance is going to go only up and up and up and up until what point? It’s not sustainable, unfortunately,” Carvajal said.

The goal of bringing an “affordable” senior living product in the market has become “very difficult” due to costs rising, Carvajal explained.

“Staffing, inflation, costs of goods have gone up, now inflation is up, it gets to a point where the business doesn’t make any more sense,” Carvajal said.

“Is the alternative, just get out of the business entirely, or leave the state? Maybe that’s the alternative here for us as a business owner – and that’s what I think is going to ultimately happen if this is not controlled,” Carvajal said.

Property insurance premiums increased “about 27%” in Florida last year, according to reports.

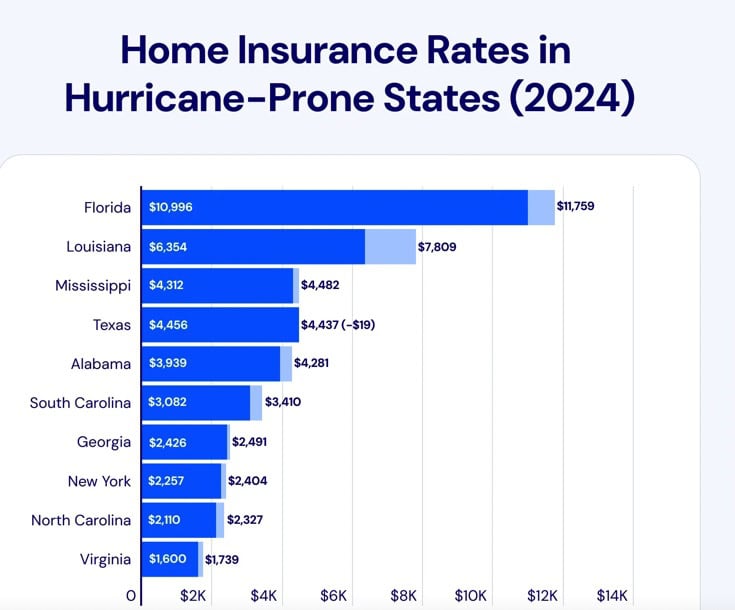

In 2023, the national average for annual home insurance was $2,377 according to Insurify. In Florida, the average was $10,996 annually for home insurance – nearly five times the national average.

In 2024, Insurify predicted costs will increase an additional 7% to $11,759.

Jeff Fusco and Megan Horner, real estate advisors in the Gulfport area told Florida’s Voice about their “frustrating” experiences with property insurance.

Fusco, who has owned a multi-unit in Gulfport since 2020, said he has seen repeated cancellations from Citizens Property Insurance in addition to his cost of property insurance doubling in four years.

“Originally, we started out around $4,500 and now we’re about $9,000,” Fusco said.

“We keep having to figure out how to re-instate our insurance every six, eight months, and it keeps going up every single time,” Fusco said. “It’s been a struggle.”

“They will claim they’re gonna cancel the policy, but Citizens, ultimately, the only reason they’re canceling a policy is that they’re limited by how much they increase a given policy within a year,” Horner explained.

“So they’ll cancel your policy, so that you have to gain a new policy, so that they can increase it, how much would be market value, essentially, for them,” Horner continued.

Florida’s Voice asked Horner her thoughts on the OIR’s report of a “downward trend” in property insurance rates in 2024’s filings, indicating possible “stabilization.”

“So yes, in theory, they could tell us they saw a rate decrease, but that rate decrease was exclusively based on things [we] did and upgrades [we] made to our home, so it didn’t mean not spending money, it meant that money not going to the insurance company,” Horner said.

“So I feel like those numbers can be skewed and fictitious in that way – that they aren’t telling the whole story,” Horner continued.

Bijou Ikli, ceo of the Florida Assisted Living Association told Florida’s Voice they are “acutely aware of the challenges posed by escalating insurance costs.”

FALA is the “largest state association representing nearly 500 assisted living facilities and adult family care homes and nearly 300 associate members who provide products and services to assisted living,” according to their website.

“Over the past year, we have observed a marked increase in premiums, which has placed a huge financial burden on ALFs [assisted living facility] across the state,” Ikli said.

Ikli said small assisted living facilities, and those who care for low-income and limited mental health residents are being “hit extremely hard,” noting these types of facilities “already operate on slim margins and reimbursement rates have not increased to help offset these rising costs.”

She said this issue is “not just affecting the bottom line of these facilities but is jeopardizing the continuity of care for many vulnerable seniors.”

Ikli said the association is “committed to advocating for sustainable solutions” and they “urge all stakeholders to recognize the critical role that ALFs play in our communities.”

“We must actively engage with insurance providers, state legislators, and regulatory agencies to address this crisis,” Ikli said.

Looking ahead, Ikli said the association will “continue to lead efforts in seeking both immediate relief and long-term stability for our members.”

Florida’s Voice reached out to the OIR for a request for comment and did not receive a response.