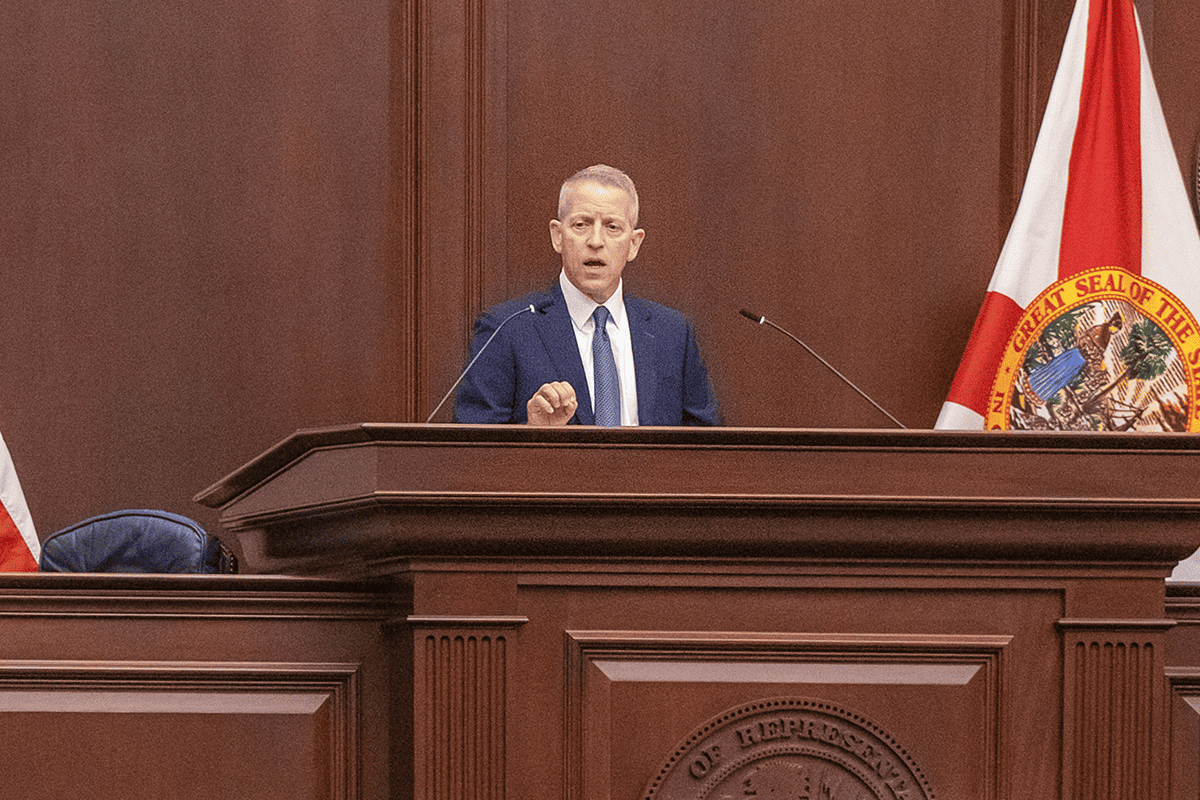

House Speaker Renner responds to Farmers Insurance pull out

Owen Girard contributed to this report.

TALLAHASSEE, Fla. (FLV) – House Speaker Paul Renner, R-Palm Coast, issued a statement after Farmers Insurance reportedly plans to leave Florida, as the company noted “concerns of extreme weather and hurricanes as a major risk in the property insurance market.”

Renner said the Florida Legislature took “great strides to bolster our insurance market to create an environment where companies can provide stable and reliable coverage for Floridians.”

“We understand the unfortunate decision to withdraw from the state was not based on the impacts of bipartisan reforms in recent years taken by the Legislature or the future of the state’s insurance market, but the company’s financials,” Renner said.

In December 2022, Gov. Ron DeSantis signed a sweeping property insurance bill that aimed to stabilize a “crumbling” insurance market.

Renner said while the reforms will “take time to take effect,” he believes they “put the right systems in place to strengthen our insurance market and provide Floridians with the access to coverage and peace of mind they need for their property.”

The Florida Legislature took great strides to bolster our insurance market to create an environment where companies can provide stable and reliable coverage for Floridians.

— Paul Renner (@Paul_Renner) July 12, 2023

On Monday, the insurance company informed the state that they would be “pulling several home, auto, and umbrella policies out of Florida.”

The move is expected to impact 100,000 policy holders.

“With catastrophe costs at historically high levels and reconstruction costs continuing to climb, we implemented a pause on writing new homeowners policies to more effectively manage our risk exposure,” the company said in a statement to the Tampa Bay Times.

Florida’s Office of Insurance Regulations told Florida’s Voice that they had received a market reduction notice from Farmers Insurance Group on Monday. It is currently “under review” to be in accordance with Florida statutes.

On July 11, Insurance Commissioner Michael Yaworsky sent a letter to Farmers Insurance expressing “disappointment.”

NEW: Fla. Office of Insurance Regulation responds to Farmers Insurance's plans to pull several policies out of Florida

— Florida’s Voice (@FLVoiceNews) July 11, 2023

"We are disappointed by the hastiness in this decision and troubled by how this decision may have cascading impacts to policyholders."

"Farmers committed… pic.twitter.com/N5fP1WECdq

“We are disappointed by the hastiness in this decision and troubled by how this decision may have cascading impacts to policyholders,” Yaworsky said.

Yaworsky said Farmers has noted that this decision “only impacts about 26.6% of their Florida policyholders,” but the impacts “should not be taken lightly.”

“Farmers committed to facilitating a seamless and efficient assumption of affected policyholders to other companies who may have interest in growing their presence in Florida […] I appreciate those commitments and will hold you to them,” the letter said.

The office explained that insurance companies have to give a 90 days notice to them in writing if the insurer desires to discontinue one or multiple lines of insurance in Florida.

When the 90 days lapse, they then must give the policyholders 120 days notice before the policies issued date of non-renewal is put into effect.

A potential decision by Farmers Insurance to end policies in the state was met with push back by the public and elected officials.

Chief Financial Officer Jimmy Patronis said that the insurance company had “zero communication” and that his office is going to explore every avenue possible to “hold them accountable.”

”[You] don’t get to leave after taking policyholder money,” he said on social media.

Patronis also said Farmer Insurance’s actions are “less a representation of the Florida market – and more of bad leadership on the insurer.”

Sen. Jason Pizzo, D-Hollywood, took to social media to comment on the news.

“While campaigning on woke, Florida’s leadership has been asleep,” Pizzo said.

Florida has seen record insurance rates over the recent years.

The state legislature has attempted to combat the rising premiums and costs by implementing insurer-friendly policies that are meant to incentivize companies to stay and do business with Florida residents.

Florida also committed to providing increased disaster relief and financial protections that hoped to benefit both the insurance companies and policyholders.