Lawmakers to consider $1.2 billion in tax relief

TALLAHASSEE, Fla. (FLV) – Lawmakers are considering legislation to provide $1.2 billion in tax relief to families and businesses across the state, with a focus on short-term as well as permanent exemptions on certain items.

The legislation permanently exempts the sale of products from sales and use tax, including machinery and equipment used to produce renewable natural gas, baby and toddler products, diapers and incontinence products, oral hygiene products and firearm safety devices.

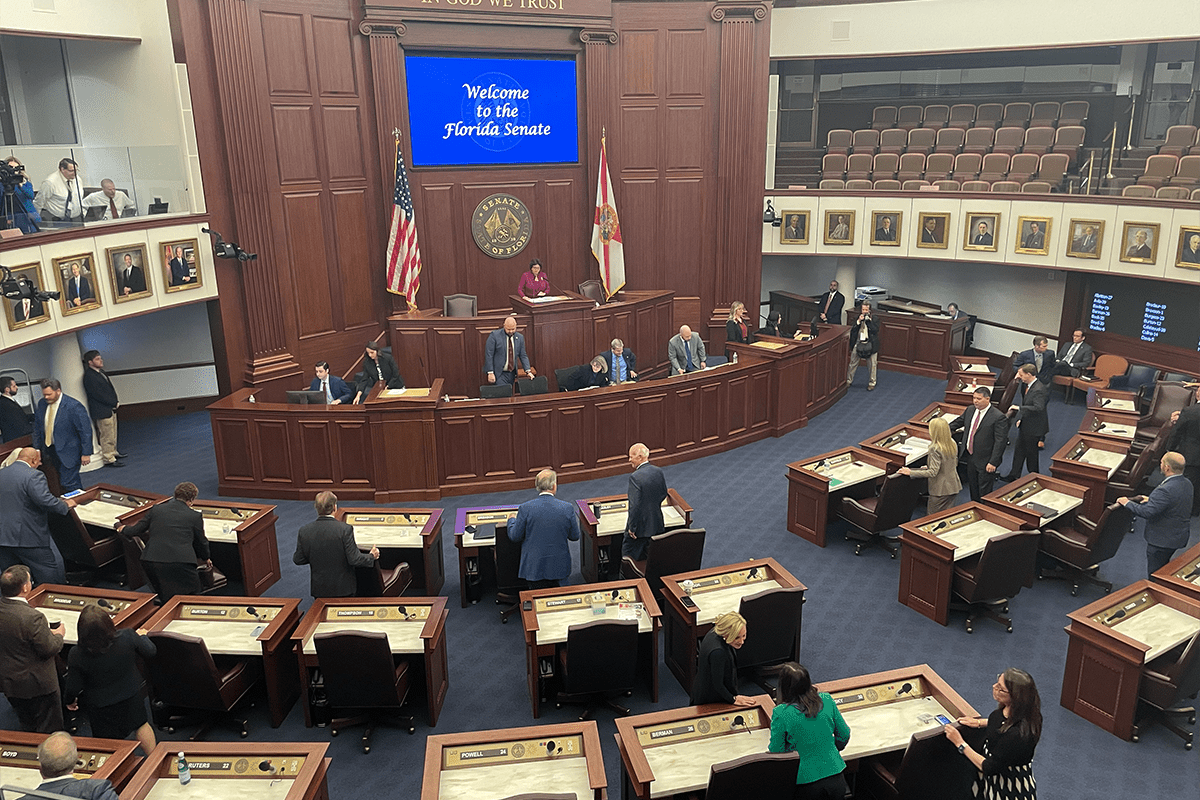

Sen. Blaise Ingoglia, R-Springhill, is chairing the committee taking up the bill during Tuesday’s Senate Committee on Finance and Tax.

The legislation creates two 14-day “back-to-school” sales tax holidays, a 14-day “disaster preparedness” sales tax holiday, expands “Freedom Week” to “Freedom Summer,” a 3-month Sales Tax holiday on recreational items, and more.

“Florida cannot independently fix or outpace runaway inflation caused by excessive spending and socialist policies in Washington,” Ingoglia said in a press release.

“While the federal government just keeps printing money, here in Florida under the leadership of Governor DeSantis and the Florida Legislature, we are saving it and living within our means, so we can reduce or eliminate taxes charged when Floridians purchase key items needed to run a household, raise a child, or age with dignity,” Ingoglia continued.

The bill will also provide additional property tax and business tax relief measures.

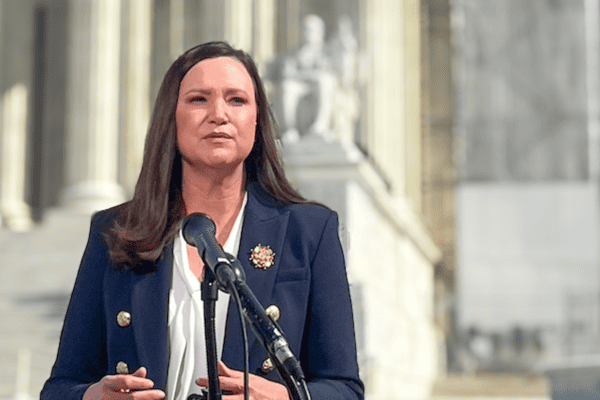

Senate President Kathleen Passidomo, R-Naples, said inflation has led to “significant increases in costs that are negatively impacting families, especially our most vulnerable.”

“However, we are working to ease the pain with broad-based sales tax relief that will be very meaningful for families and seniors,” Passidomo explained.

“This bill creates tax relief opportunities for growing families with new babies, or kids heading back to school, for Floridians looking to prepare their homes for severe weather, and for Floridians, young and old, who want to get out and enjoy all the beautiful natural resources and fun events the free state of Florida has to offer this summer,” Passidomo continued.

Senate Democratic Leader Lauren Book, D-Davie, released a statement on Monday. Book has previously championed legislation for a permanent diaper tax.

“I am proud of our bipartisan work on this year’s Senate tax package which now includes tax relief for baby diapers and incontinence products for Floridians of all ages – because essential health and hygiene items should not be taxed, and Florida families should not be forced to choose between filling up their gas tank, putting food on the table, or buying needed diapers,” Book said.

Editor’s Note: This story was edited to include that Sen. Blaise Ingoglia is chairing the committee.