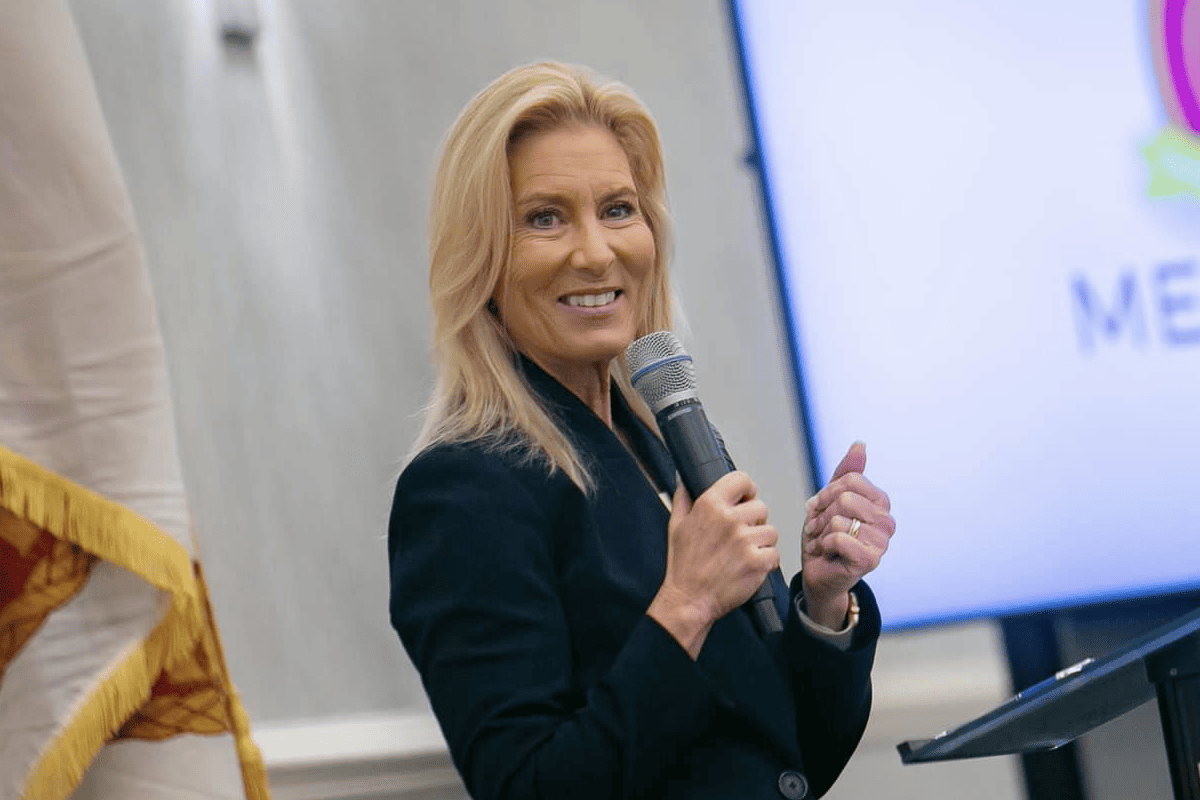

Mayor Donna Deegan pledges $10 million for Jacksonville’s affordable housing initiative

JACKSONVILLE, Fla. – Jacksonville Mayor Donna Deegan unveiled a bold initiative in her proposed 2024-2025 budget, earmarking $10 million to kickstart an innovative affordable housing loan fund.

The public-private partnership loan fund aims to accelerate a staggering $120 million influx into new multifamily rental housing developments.

“We’re facing a crisis of affordable housing in Jacksonville, and this innovative housing fund presents the opportunity for us to attract an additional $12 of investment for every $1 the city invests,” Deegan said.

The mayor plans to incorporate the $10 million allocation into her budget, scheduled for presentation to the city council in July and then will await the council’s approval in the fall.

“This shows what is possible when we all come together to find solutions to our city’s challenges,” Deegan said. “I’m grateful for all the philanthropic, business, City Council, and community leaders who are working together to solve the challenge of affordable housing.”

The fund’s capitalization will be a collaborative effort, drawing from public, private, and philanthropic sources to provide developers with low-interest loans. These funds will facilitate access to underutilized 4% tax credit financing from the state.

Private and philanthropic investment must total $30 million to match the city’s $10 million, according to the mayor’s office, which would then enable developers to access further funding from various avenues like bond financing, tax credit equity and bank loans.

The mayor’s office said partners including the Jessie Ball duPont Fund, the Community Foundation for Northeast Florida, and Northern Trust have signaled their intention to participate as investors in this initiative.

“The duPont Fund and our partners have conducted research and been in conversations with experts for years about the most effective strategies to finance affordable housing in Jacksonville,” President of the Jessie Ball duPont Fund Mari Kuraishi said. “This model is unique because it can attract private and philanthropic dollars that would otherwise be sitting on the sidelines and return the capital to be re-invested in the community.”

Notably, the city’s $10 million investment will take the form of a loan, repayable at the conclusion of a 20-year investment period.

This initial allocation stands as a crucial cornerstone of a larger $40 million affordable housing fund. By leveraging additional investors, the city’s contribution will magnify the impact of the dollars invested, extending far beyond the original sum, according to the mayor’s office.

“We must tackle our affordable housing crisis on all fronts, and this fund could be a critical piece of the puzzle for building more inventory,” Councilman Michael Boylan said. “I look forward to exploring the concept more with my colleagues and building on the work of our special committees focused on this important issue.”

The mayor’s office pointed to research studies indicating that the average renter in Jacksonville has been burdened by rent since 2011, allocating over 50% of their income towards housing costs. Furthermore, households earning 50% or less of the Area Median Income, or AMI, are confronting a significant shortage in available housing.

According to data from the University of Florida Shimberg Center for Housing Studies, for every 100 renters at 50% AMI seeking housing, only 48 affordable units are accessible to them.

Meanwhile, developers striving to bolster the inventory of affordable housing units encounter a significant shortfall in gap financing, the mayor’s office said. In 2023, Duval County developers submitted applications totaling over $50 million for low-interest loans from the Florida Housing Finance Corporation under their State Apartment Incentive Loan program, with many of those requests left unmet.

The establishment of this community-specific fund would mark Florida’s inaugural initiative to establish a local reservoir of gap financing, allowing the progression of proposed projects.

The administration of the fund would be undertaken by Self-Help Ventures Fund. Projections suggest that this partnership could underwrite the acquisition and development of 500-1,000 housing units throughout the tax credit compliance period.

“Florida has prioritized affordable housing through an existing vehicle for providing funding to developers – the statewide SAIL program for low-interest loans to developers building affordable housing units – but that vehicle runs out of fuel every year,” President of Self-Help Ventures Fund Amanda Frazier Wong said. “This loan fund puts more fuel in the tank so that more affordable housing can be built and preserved each year.”

The capital within the loan fund is designed for reinvestment, ensuring a sustained augmentation of housing supply for generations to come.