Media: ‘Experts’ dismiss DeSantis ‘theory’ of central bank digital currency overreach

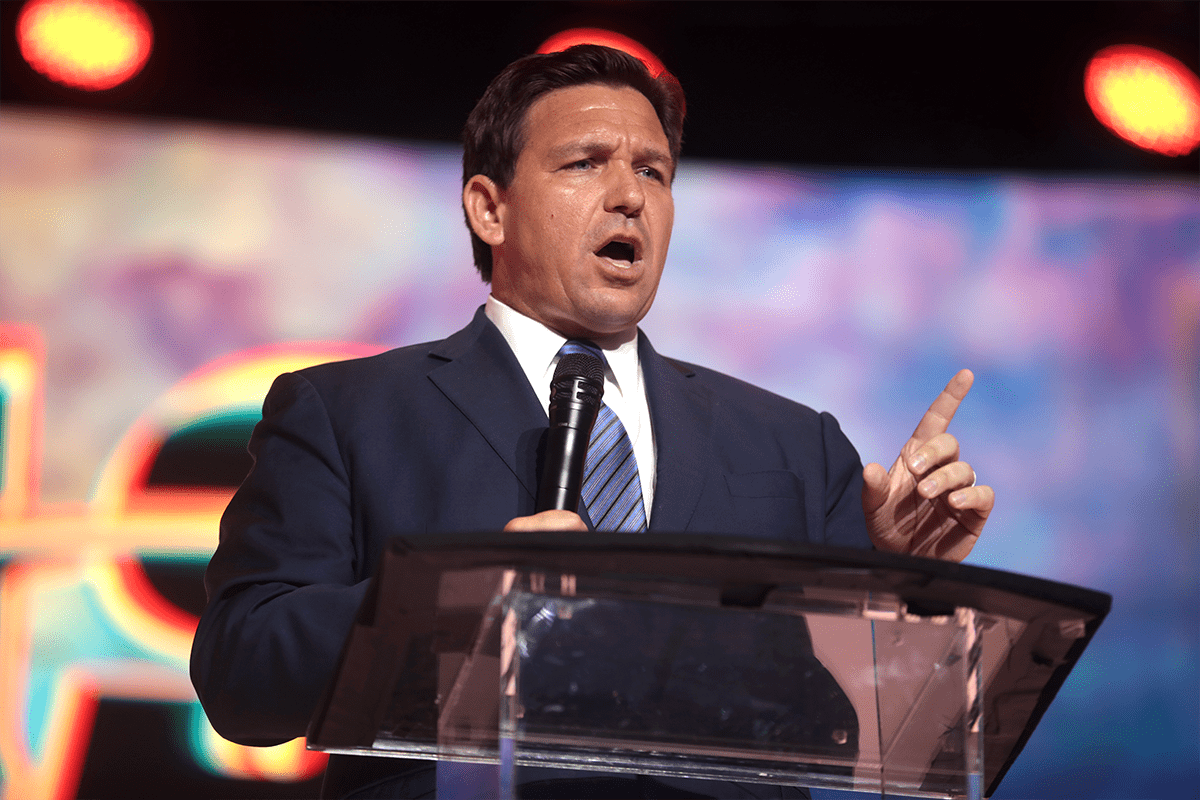

TALLAHASSEE, Fla. (FLV) – Reports have circulated aiming to disprove Gov. Ron DeSantis’ warnings about the U.S. Federal Reserve potentially planning to implement a central bank digital currency, enabling more government control over everyday transactions from Americans.

“Ron DeSantis’ baseless theory that the government wants to control people’s purchases,” a PolitiFact headline reads.

The “fact check” was also republished in the Tampa Bay Times.

“Anytime the media works THIS hard to convince you not to worry about something is the time to start paying attention,” DeSantis press secretary Bryan Griffin said. “Thanks to @GovRonDeSantis, Florida will be an obstacle to centralized control via digital currency.”

In the report, PolitiFact cited “multiple experts” having “dismissed” the idea that the federal government would try “to control a digital dollar.”

“The Federal Reserve is studying the possibility of creating a digital currency,” they noted.

Griffin told PolitiFact the idea that the government would try to implement a central bank digital currency, or CBDC, “leaves plenty of room for concern.”

“Centralized currency provides an avenue for the controlling entity to push an agenda,” Griffin said, pointing to moves by China’s government to increase surveillance of its citizens through the use of centralized digital currency.

PolitiFact

PolitiFact then disputed Griffin’s and DeSantis’ worries by citing “banking experts” who are in “broad agreement” that DeSantis’ comments “overstate” the risk of such a system emerging in the United States.

In March, DeSantis called for a total ban on CBDC in Florida.

In April, DeSantis slammed the Federal Reserve for comments surrounding CBDC.

“I am here to call on the legislature to pass legislation to expressly forbid the use of CBDC as money within Florida’s uniform commercial code,” DeSantis said at a Panama City press conference last month.

He said the proposal will make sure Florida continues to support innovation in the financial sector “while protecting against government surveillance over your personal finances.”

Legislation has been filed in the House and Senate addressing CBDC.

“It is not merely ‘ideal’ that major changes in policy receive specific authorization from Congress; it is constitutionally required,” DeSantis said. “Unaccountable institutions cannot impose a CBDC on Americans. They will tell us that CBDC won’t be abused but we are wise enough to know better.”

“This wolf comes as a wolf.”