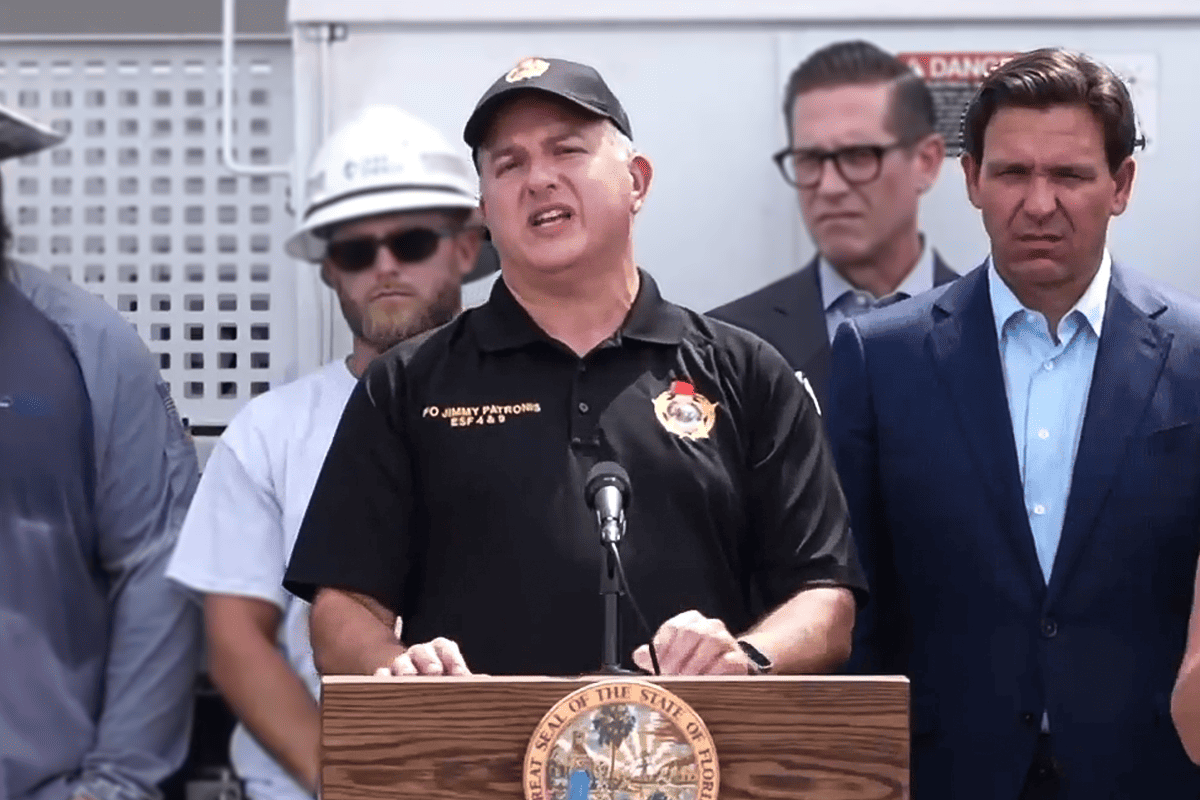

Patronis announces proposal to ‘fight back’ against IRS use of AI

NAPLES, Fla. – Florida Chief Financial Officer Jimmy Patronis and Sen. Rick Scott, R-Fla., announced proposed legislation Friday to “fight back” against the use of Artificial Intelligence technologies being “corrupted” by the Internal Revenue Service.

The proposed legislation was announced during Patronis’ IRS Roundtable and would be used to identify state vendors who provide artificial intelligence services to the Internal Revenue Service.

“It’s fitting that we’re discussing the IRS on Friday the 13th,” Patronis said. “The idea of the IRS using Artificial Intelligence to go after law abiding taxpaying citizens is like something from a 1980’s sci-fi horror movie.”

Patronis’ office said that according to media reports, the Internal Revenue Service has started using Artificial Intelligence to investigate taxpayers.

“My constitutional duty is to protect Floridians, so for the upcoming session we will propose legislation to survey all state vendors to assess whether they’re providing AI services to the IRS,” Patronis said.

“On many occasions, the vendors who provide services to the federal government also serve the State of Florida, and so that’s an opportunity to learn more on how we can fight back,” he continued.

Scott said it is “no secret that Washington has weaponized the IRS against Americans.”

“The thought of 87,000 more IRS agents is terrifying,” Scott said. “I’m fighting to reverse this terrible decision by the Biden administration and in Florida, we will arm our small businesses with the tools they need to fight back.”

“I appreciate CFO Patronis’ leadership on this issue and hosting today’s roundtable to shed some light on this important topic,” he said.

Collier County Commissioner William McDaniel said he is “grateful for the opportunity” to work with Patronis and “hold big government and big tech accountable,” giving local communities a “chance to fight back.”

“Our local economies and small businesses are the economic engines that drive our state forward,” McDaniel said. “Florida is proud of our heritage of promoting and living the American dream. Those dreams are at risk as long as the IRS is allowed free reign to target these hard-working business owners just to fill their coffers.”

Collier County School Board Member Erick Carter said he was ”honored” to join Patronis and Scott to “shine a light on IRS overreach.”

“As a small business owner, it’s hard enough to make payroll and a profit without the IRS looking over our shoulders and digging into our cash register,” Carter said. “I’m thankful that the state of Florida is speaking up for taxpayers and small businesses.”

During the roundtable, Patronis also highlighted his Florida IRS Transparency Portal, which was created for individuals, private businesses, or non-profits to report evidence of discrimination by IRS operatives.

The portal was was created to help Florida identify patterns of discrimination where specific IRS agents are targeting certain political causes, practices, or beliefs.

Submissions to the transparency portal will be forwarded to the congressional committee overseeing the IRS for further investigation. Florida residents and businesses can report harassment by IRS agents here.