Property insurance firm hit with $1 million fine for mishandling claims post-Hurricane Ian

TALLAHASSEE, Fla. – A property insurance firm consented to a $1 million fine, as per an order signed on Thursday, subsequent to a state assessment revealing its infringement of claims-handling following Hurricane Ian.

A consent order signed by Florida Insurance Commissioner Michael Yaworsky states that Heritage Property & Casualty Insurance violated multiple provisions of the Florida Insurance Code as revealed in their 2024 Targeted Market Conduct Examination conducted by the Office of Insurance Regulation.

The period of examination was from Sep. 28, 2022 to Feb. 28, 2023. Hurricane Ian, the catastrophic Category 5 storm, made landfall Sep. 28, 2022.

In March, the office completed the examination of the property insurance company to review its Hurricane Ian claims-handling operations.

The office recorded the following instances of Heritage Property & Casualty Insurance breaching the Florida insurance code as follows:

- Failure to acknowledge receipt of a claim communication within 14 calendar days in 98 instances.

- Failure to provide the policyholder with a document containing the adjuster’s name and license number in 139 instances.

- Failure to include the name and license number of the adjuster in a subsequent communication regarding the claim in 66 instances.

- Failure to pay or deny a claim or a portion of the claim within 90 days after notice of an initial, reopened, or supplemental property insurance claim in 70 instances.

- Failure to calculate the correct amount of interest owed on payment of a claim in 59 instances.

- Failure to pay interest when the claim payment was made 90 days after receiving notice of the claim in four instances.

- Failure to provide a Homeowner of Claims Bill of Rights to a policyholder within 14 days after an initial claim communication in 46 instances.

- Failure to utilize properly appointed adjusters or utilized emergency adjusters before the appropriate license was issued by the Florida Department of Financial Services in 13 instances.

- Failure to complete claims experience records in 10 instances.

The consent order states that the property insurance company has agreed to pay an administrative fine of $1 million as well as “administrative costs” of $10,000 to the Florida Office of Insurance Regulation within 10 days after receiving the order.

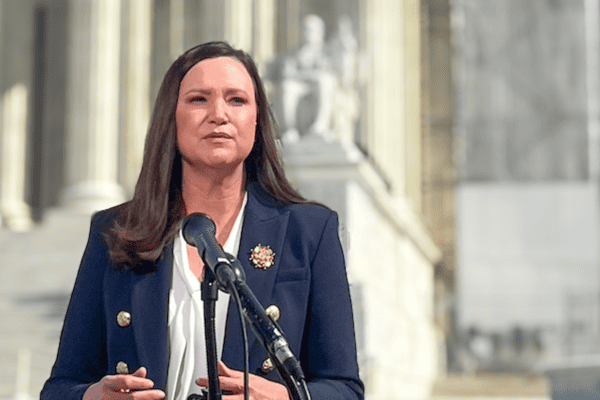

Florida Senate President Kathleen Passidomo, R-Naples, commented on the situation

Following the order being complete, if the company violates any of the terms and conditions contained in the order, “without further proceedings,” Heritage will face suspension, revocation, or any other administrative action deemed appropriate.

If the company fails to comply with any of the terms and conditions contained in the order, they may also be subject to additional penalties and fines.

If the company commits any future violations of Florida statutes listed in the order, they will be subject to penalties as the “office deems appropriate.”

The consent order stated that the property insurance company “knowingly and voluntarily” waived all rights to challenge or contest the order.