STUDY: FL Senate Committee Passes Auto-Insurance Bill that would Raise Rates

February 7, 2022 Updated 9:47 A.M. ET

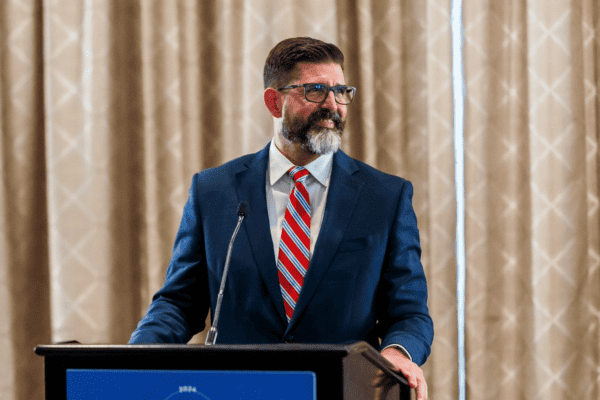

TALLAHASSEE (FCV) – The Florida legislature is moving forward with a proposal that would eliminate a requirement that motorists must carry personal-injury-protection (PIP) and require that they have bodily injury coverage. SB 150, sponsored by State Senator Danny Burgess (R), was approved by the Senate Banking and Insurance Committee.

FCV reported on the measure last month, with a study showing that premiums may jump by approximately 50%, according to a study from Pinnacle Actuarial Resources.

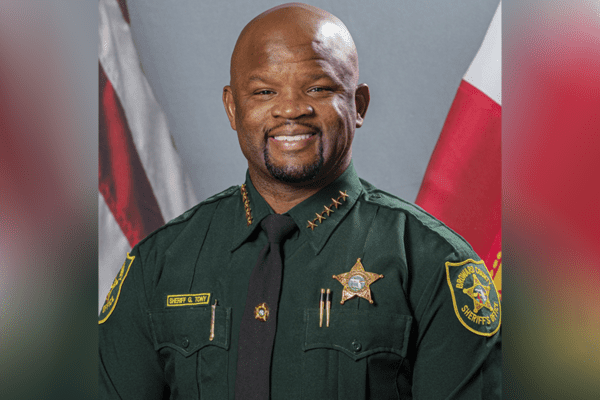

Chief Financial Officer Jimmy Patronis said that the bill will raise rates on lower income Floridians. “The last three years in a row, I’ve expressed my reservations about switching from PIP to BI because the outcome has shown an increase in insurance costs. I still have those reservations,” he remarked.

“I grew up in a service industry, I had employees that work from month to month, and if you increase their insurance rates by $15 or $18 a month, that’s real money to somebody’s pocket.”

Patronis also explained that the bill will negatively impact the healthcare system through the form of strain on other services.

“Are you going to see increased utilization and Medicaid? Are you going to see increased uses of other insurance products? Are you going to see increases in bad debt at hospitals?” he remarked.

However, Burgess disagrees with this assessment.

“This product is going to reduce rates,” Burgess remarked after a meeting to advance the bill. “It’s just obviously a big, scary topic. And we (have) just got to get everybody to wrap their arms around it and realize it’s a process. There’s still some ways to go.”

Critics of the bill wonder where Burgess came to the conclusion that the reform would lower rates rather than raise them. Simply explained, when the government requires people to purchase more insurance, the price will necessarily increase, which is a large part of why many disagree with Burgess.

Law.com reports that rates could even leap as much as 77% for some drivers. State Senator Jeff Brandes said that he cannot support a measure that poses this risk.

“This is essentially, in my opinion, legislative malpractice that we are going to talk about a piece of legislation that affects the lives of millions and millions of Floridians and we have not, over the summer, got an actual study that says, based on the actuaries and based on the counsel that we’ve received, this is going to reduce rates by x,” he said.

Currently, motorists in Florida with minimum coverage pay around $585 per year for car insurance. If the law passes, which would repeat the “no-fault” provision of current Florida law, premiums could rise to approximately $868.

The American Property Casualty Insurance Association also says that the proposals would increase insurance costs, particularly for those with minimum coverage.

Governor Ron DeSantis (R) vetoed a similar proposition from Republican lawmakers last year, which FCV reported on exclusively. He is again expected to veto the legislation.

Last year, DeSantis’ veto letter characterized the legislation as that which would “negatively impact both the market and consumers.”

“[The bill] does not adequately address the current issues facing Florida drivers,” he said.

The bill is awaiting further hearing in the Senate Judiciary committee.