Florida home insurance costs to continue rising with rest of U.S., report says

TALLAHASSEE, Fla. – Home insurance costs in Florida are predicted to increase an additional 7% in 2024, according to Insurify.

Insurify noted that the surge in home insurance costs across the country are driven by climate-related disasters and economic inflation.

Over the two-year period from 2021 to 2023, there was a notable uptick in the average annual rate in the U.S., surging by 19.8% from $1,984 to $2,377.

Insurify predicted the country’s annual projected rate in 2024 will rise by 6% to $2,522.

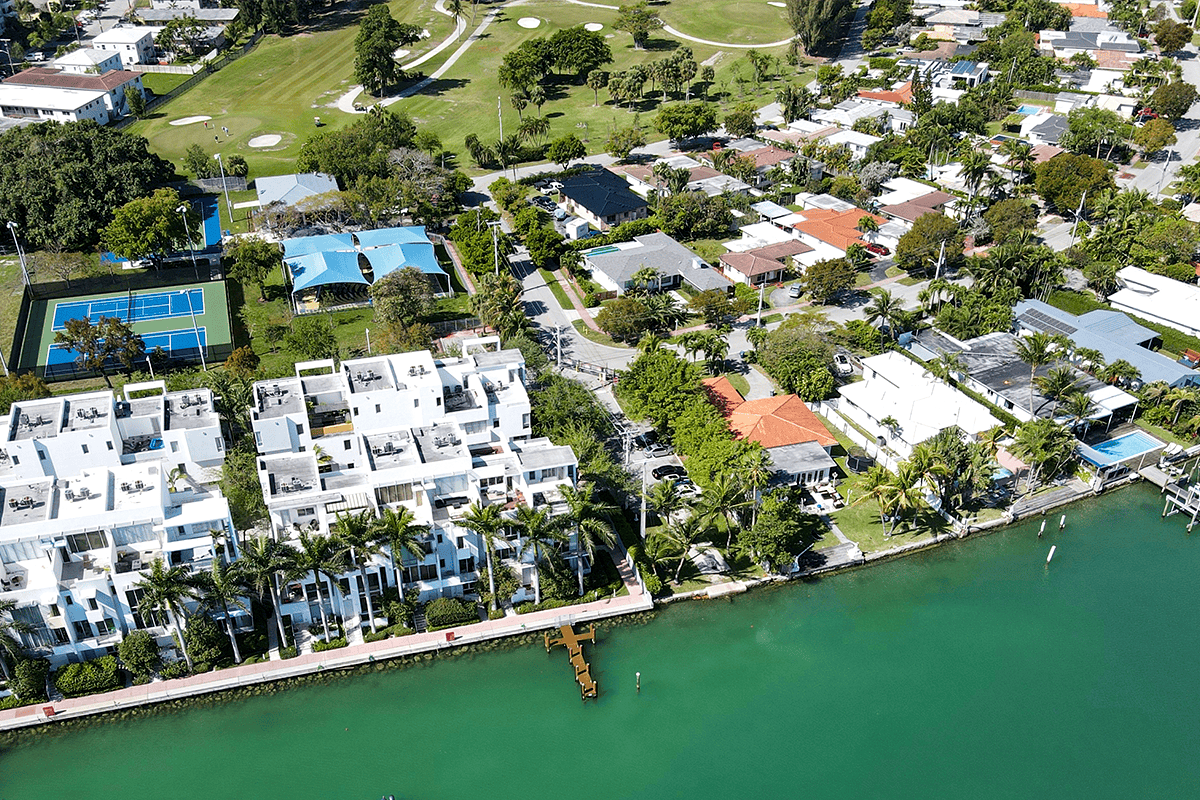

According to the data, in 2023, Florida homeowners bore the highest burden of home insurance expenses, facing an average yearly premium of $10,996, which is $8,619 more than the U.S. average.

Anticipating further financial strain, Insurify forecasts a 7% surge in costs by the end of 2024 in Florida, projecting a new average of $11,759.

In order to pinpoint the states experiencing the most significant impacts from escalating rates, Insurify’s data science team conducted an analysis of homeowners insurance expenses across all 50 states. They then forecasted rate hikes by drawing from historical pricing trends and considering localized factors.

Florida claims dominance in home insurance expenses, with six out of the top 10 priciest cities for homeowners insurance situated within the state.

According to a November 2023 survey conducted by Cygnal, 91% of Florida residents expressed worry over homeowners insurance rates.

Additionally, 59% of respondents reported a perceived deterioration in their personal finances compared to the previous year.

“Everybody is concerned about it,” South Florida Realtor Désirée Ávila said. “Because of all the storms and hurricanes and weather events that happen here in South Florida, we’ve just seen, over the past years, homeowners insurance go up a lot.”

The insurance turmoil in Florida has intensified in recent years, marked by a cascade of over a dozen home insurance companies declaring insolvency since 2019.

Notably, Farmers Insurance ceased operations in the state, while prominent insurers have opted not to renew policies for residences deemed high-risk.

Sen. Ed Hooper, R-Palm Harbor, highlighted to Florida’s Voice where the state’s money is spent and how much funding the state has set aside for a growing population in need of better roads, bridges, airports, seaports, and being prepared for catastrophic events. He said that Florida is “probably in the best financial condition of any state in the union.”

“We have incredible reserves we’re in a position where we can put a fair amount, I think more than $10-billion in reserves,” Hooper said. “We have a nice fund called the CAT fund for hurricane preparedness and spending should a devastating storm hit Florida.”

However, one area of concern Hooper continues to work toward is helping Floridians address the rapidly rising costs of car insurance and homeowner’s insurance.

In response to the insurance crisis, the Florida Legislature has implemented measures targeting two key contributing factors: legal system exploitation and the misapplication of assignment of benefits. Among these initiatives is SB 7052, which aims to bolster consumer safeguards and address systemic vulnerabilities.

States grappling with the steepest home insurance expenses often find themselves at the mercy of extreme weather occurrences, Insurify noted. Florida, Louisiana, Texas, Arkansas and Mississippi, susceptible to hurricanes, bear notable burdens.

Meanwhile, Texas, Colorado and Nebraska confront escalating wildfire threats. Additionally, Nebraska, Texas and Kansas, nestled within the region known as Tornado Alley, contend with heightened tornado risks.

Next to Florida, homeowners in Louisiana pay the second highest average annual rate in the country of $6,354 with the highest projected increase of 23% in 2024, bringing the average rate to $7,809.

Oklahoma homeowners come in third highest with an average yearly premium of $5,444 with a projected 5% increase in 2024, bringing the average rate to $5,711.

The other states that landed in the top 10 “most expensive states for home insurance in 2024” include Texas, Mississippi, Colorado, Nebraska, Alabama, Kansas and Arkansas.