Survey reveals nearly 12% of prospective Florida movers cite rising insurance costs as top reason

TALLAHASSEE, Fla. – In Florida, 11.9% of surveyed individuals intending to move within the next year attributed their decision to escalating insurance costs—a figure nearly double the national average of 6.2%.

Redfin reported findings that stemmed from a survey commissioned by the technology-driven real estate brokerage and conducted by Qualtrics in February. The survey, designed to be nationally representative, targeted 2,995 homeowners and renters across the U.S.

According to the survey, approximately 100 homeowners who took part in the survey disclosed that their insurance provider ceased offering coverage for their residences. Among these respondents, one-third, or 33.2%, either relocated or intends to relocate to an area where coverage remains accessible.

In another recent report by Redfin, it found that a significant proportion of homeowners in key states have experienced the impact of soaring home insurance expenses or alterations in coverage over the past year.

Specifically, a substantial 70.3% of homeowners in Florida and 51% in California have reported feeling the effects, whether through increased costs or policy adjustments such as being dropped by their insurer.

This contrasts starkly with the national average, where only 44.6% of homeowners have encountered similar challenges.

As of April, eight new property and casualty insurance providers have entered the market after recent Florida reforms.

Homeowners in Florida and California are particularly concerned about insurance due to the ongoing housing crisis in these states, according to Redfin. Many have witnessed significant increases in their premiums, while others have been left without coverage entirely as a result of heightened risks associated with natural disasters.

The intensifying threat of natural calamities has led numerous insurers to cease operations. Notably, 11 insurers in Florida have been liquidated due to the mounting concerns surrounding flood and storm hazards.

Around 12% of respondents from Florida and 10.7% from California reported that their insurance provider ceased offering coverage for their homes, in contrast to 8.3% of respondents overall.

Concerns about potential future insurer actions are prevalent among homeowners, according to the survey. In Florida, over 27.7% of respondents expressed worry about the possibility of their insurer discontinuing coverage for their homes. This compares to 13.5% of respondents in California and 8.9% of respondents overall who share similar apprehensions.

The majority of respondents have experienced an uptick in insurance expenses. Across the board, nearly 71.7% indicated that their policy premiums have risen. Specifically, a slightly higher proportion in Florida, 76% reported increased costs.

In 2023, Florida homeowners bore the highest burden of home insurance expenses, facing an average yearly premium of $10,996, which is $8,619 more than the U.S. average, according to data from Insurify.

Anticipating further financial strain, Insurify forecasts a 7% surge in costs by the end of 2024 in Florida, projecting a new average of $11,759.

Over the two-year period from 2021 to 2023, there was a notable uptick in the average annual rate in the U.S., surging by 19.8% from $1,984 to $2,377. Insurify predicted the country’s annual projected rate in 2024 will rise by 6% to $2,522.

Despite some people choosing to leave disaster-prone regions, a separate 2023 analysis revealed states such as Florida, Texas, and Arizona have experienced a surge in popularity.

For example, over the two years following Hurricane Ian, Lee County, which encompasses areas like Fort Myers and Cape Coral, and was heavily impacted by the storm, have seen an influx of nearly 60,000 more people moving in than out, according to Redfin’s analysis.

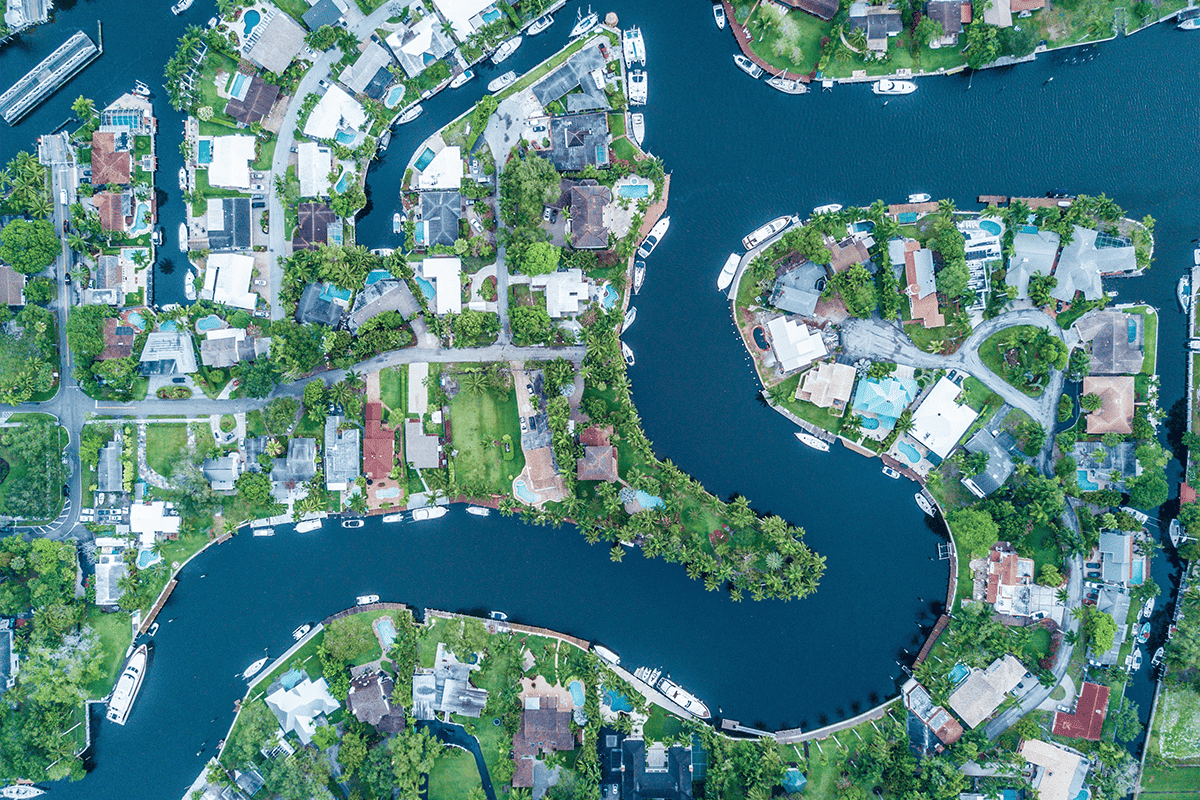

“Many folks who moved into Florida from the Northeast or the West during the pandemic are leaving, but they’re quickly being replaced by new out-of-staters,” Redfin Premier real estate agent Isabel Arias-Squires said in the 2023 report. “Some people just want to be on the water no matter what, and/or they want to move here for family, weather or political reasons. The Cape is not slowing down.”

Sen. Jim Boyd, R-Bradenton, spoke to Florida’s Voice about the legislature’s efforts to implement property insurance reform in Florida, as a growing number of citizens consider the issue to be top of mind.

“The property insurance reform, coupled with tort reform, is going to make a massive difference in homeowners’ premium costs over the foreseeable future,” he said.

“The reality is is that most people haven’t seen it in their rate reductions, or most of it, because it takes a year and a half to 18 months for those changes to filter through the rate making process,” he added.