Bipartisan bill to outlaw CBDC heads to DeSantis for signature

TALLAHASSEE, Fla. (FLV) – A bill that would effectively outlaw the use of a central bank digital currency, or CBDC, in Florida was passed by the House 116-1 Tuesday.

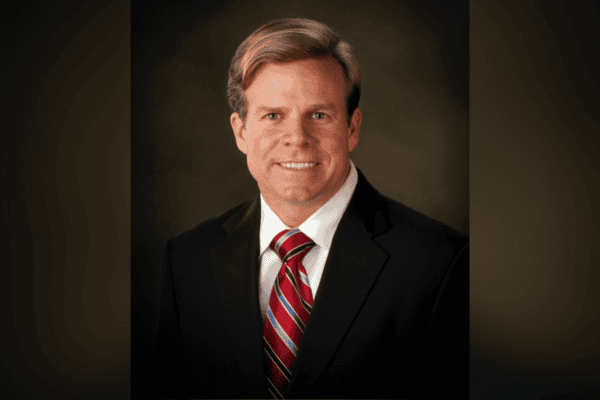

It will now head to Gov. Ron DeSantis’ desk for signature.

It previously passed the Senate 34-5.

The bill aims to prohibit the U.S. Federal Reserve implementing such a digital currency that can be centrally tracked by the federal government in Florida.

It accomplishes this by preventing CBDC from being treated as legal currency under Florida Uniform Commercial Code.

A bill analysis cited an executive order from President Joe Biden directing agencies to look into the implementation of such a system of currency. The search prompted concern from DeSantis’ office earlier this year.

The legislation came after DeSantis called for CBDC to be outlawed in March.

“I am here to call on the legislature to pass legislation to expressly forbid the use of CBDC as money within Florida’s uniform commercial code,” DeSantis said.

He said the proposal will make sure Florida continues to support innovation in the financial sector “while protecting against government surveillance over your personal finances.”

DeSantis called out the notion of the government having a “direct view of all consumer activities.”

“Any way they can get into society to exercise their agenda, they will do it […] How do we know? Because we’ve seen this happen in other parts of the world,” DeSantis said.

Tuesday at a press conference, the governor also warned the federal government that under upcoming Florida law, the state would oppose and resist the implementation of CBDC if the executive branch tried to authorize it unilaterally.

“I don’t think Congress would authorize it, but if the Fed or the Treasury tries to do it unilaterally – in Florida, we [will] have a prohibition against that,” the governor said. “That’s ensuring your financial independence and making sure that we don’t have a financial surveillance state where they know every transaction that you’re making.”