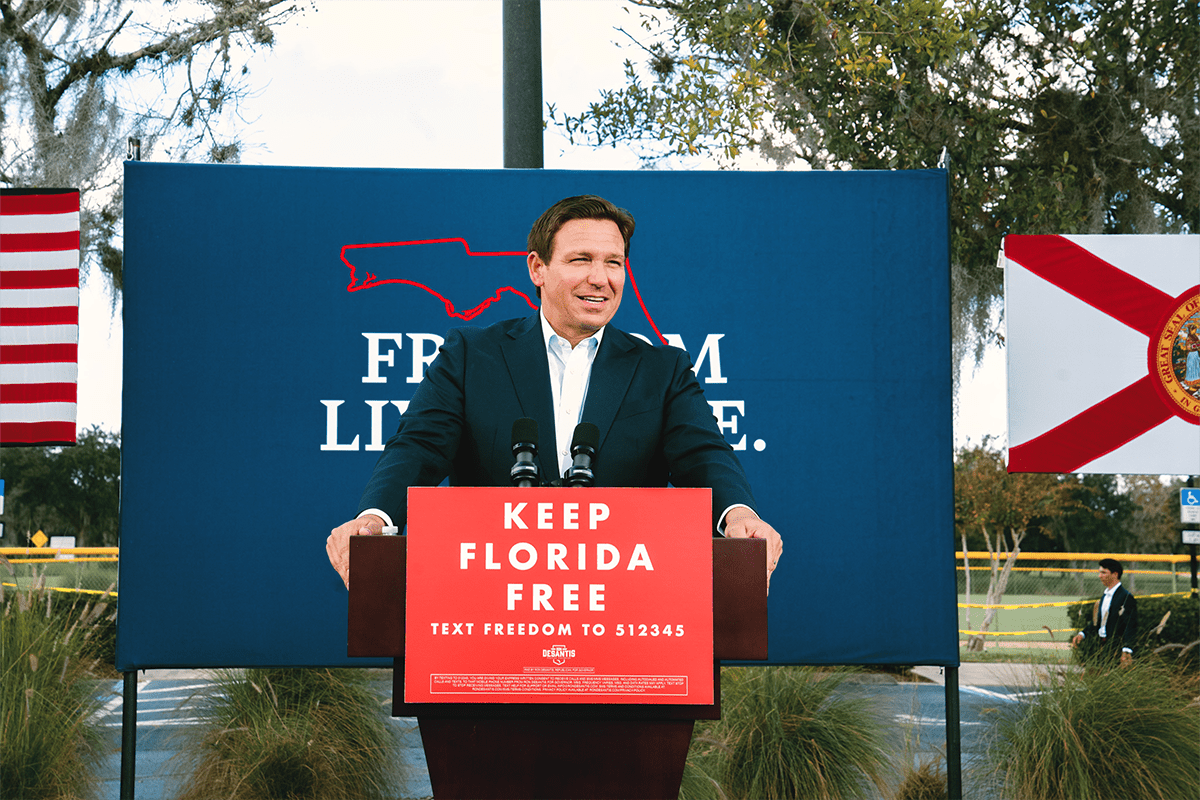

DeSantis proposes banning social credit scores in banking, targets ESG

NAPLES, Fla. (FLV) – Gov. Ron DeSantis announced a proposal to target ESG banking and investment policies on Monday.

DeSantis said he aims to enact protections for Floridians against discrimination by big banks and large financial institutions for their religious, political, or social beliefs.

ESG – environmental, social, and governance – is a business framework that determines investment based on political factors such as renewable energy and social justice initiatives.

DeSantis said ESG has developed into a “mechanism to inject political ideology into investment decisions, corporate governance, and really just the the everyday economy.”

“That is not ultimately something that is going to work out well for us here in Florida,” he said.

DeSantis said it violates the fiduciary duty that executives have to the shareholders of publicly traded companies.

“Your pension money, your retirement money, is likely invested in some of these funds, and those funds should be done to try to produce the best result for you using the availment investment options,” DeSantis said.

“What ESG says is no, we’re not going to do, even if it would do a better return – we’re not going to allow you to invest in certain areas, you’re not allowed to invest in oil and gas, you’re not allowed to invest in disfavored areas,” he explained.

The proposal includes prohibiting the financial sector from considering “social credit scores” in banking and lending practices that aim to prevent Floridians from obtaining loans, lines of credit, and bank accounts.

“That is a way to try to change people’s behavior. It’s a way to try to impose politics on what should just be economic decisions,” he said.

“We are also not going to house in either the state or local government level deposits. And we have a lot of deposit, we got a massive budget surplus in Florida, you have deposits all over the place that go in where state and local government use financial institutions, none of those deposits will be permitted to be done in institutions that are pursuing this woke ESG agenda,” he said.

The proposal would also aim to make sure ESG will not “infect decisions” at both the state and local governments, such as investment decisions, procurement and contracting, or bonds.

The Governor’s press release said the legislation would also:

- Prohibit banks that engage in corporate activism from holding government funds as a Qualified Public Depository (QPD).

- Prohibit the use of ESG in all investment decisions at the state and local level, ensuring that fund managers only consider financial factors that maximize the highest rate of return.

- Prohibit all state and local entities, including direct support organizations, from considering, giving preference to, or requesting information about ESG as part of the procurement and contracting process.

- Prohibit the use of ESG factors by state and local governments when issuing bonds, including a contract prohibition on rating agencies whose ESG ratings negatively impact the issuer’s bond ratings.

- Direct the Attorney General and Commissioner of Financial Regulation to enforce these provisions to the fullest extent of the law.

Florida Chief Financial Officer Jimmy Patronis praised DeSantis’ proposal to crack down on ESG.

“When it comes to ESG, many of us have been boiled like a frog,” Patronis said. “The Governor is right that over time ESG has wound its way into too many aspects of American society, and pulling it back is going to take work.”

“This proposed legislation puts returns first, it puts the Constitution first, and it puts corporate America on notice that if they play politics with Florida residents, we’ll have the tools to hold them accountable. I look forward to working with the DeSantis Administration, as well as Senate President Passidomo and House Speaker Renner in getting this legislation over the finish line,” Patronis said.

Patronis previously barred ESG funds’ participation in the deferred compensation program and divested around $2 billion from BlackRock due to their utilization of ESG.

House Speaker Paul Renner said Bob Rommel, R-Naples, will introduce the bill in the House.

“The biggest thing that I think ESG represents is a total hijacking of democracy,” said Renner.

“We’re lucky here in the state of Florida, that we’ve got a governor who will stand up to things like ESG, when others will not,” he said.

“This is amazing what he’s doing for our state, our state is just rocketing,” said Senate President Kathleen Passidomo.

“I look forward to having the governor come back here again and again and again to sign all these bills,” she said.

Editor’s note: This story was updated to include comment from Florida Chief Financial Officer Jimmy Patronis.