Florida lawmaker files to crack down on banks that cancel customers for illegitimate reasons

TALLAHASSEE, Fla. – Rep. Bob Rommel, R-Naples, filed a bill that will penalize banks for closing down a customer’s bank account for illegitimate reasons, or without giving a notice.

Rommel said the state will investigate on behalf of the consumer to see if there’s a legitimate reason to close the customer’s bank account.

He said if the state concludes there was no legitimate reason, such as criminal activity, it will impose fines on the institution.

Additionally, customers will be able to sue a bank if they believe their rights were taken away under HB 585.

“We’re gonna make sure that people aren’t discriminated and the only way you lose your ability to do banking [is] if you do something illegal,” Rommel told Florida’s Voice.

“The ability to do banking is everybody’s lifeline,” he said.

The bill text said a bank may be suspended or disqualified if the chief financial officer determines that it “acted in bad faith when terminating, suspending, or taking similar action restricting a customer’s or member’s account,” or if it fails to file a termination-of-access report.

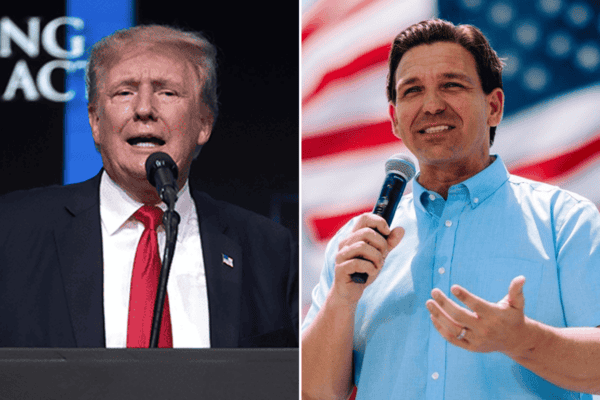

Rommel said this is a follow up from the recent anti-environmental, social and corporate governance, or ESG, legislation. Gov. Ron DeSantis signed the new law in May that addressed financial transactions and credit determinations.

“We didn’t really address the idea that you can’t just bank, you can’t have a checking account – or you can’t receive credit cards,” he said.

Rommel said if institutions are cutting off customers, authorities haven’t heard about it because they don’t currently get a report from the financial institutions.

“We want to make sure that we’re doing everything we can to protect our individuals, because unfortunately, it seems like the world has become this political football where these giant corporations are using their clout to try to change policy or the way you [customers] do business,” he said.

In May, 19 attorneys general, including Florida Attorney General Ashley Moody, sent a letter to JPMorgan Chase & Co. arguing the organization has “persistently discriminated against certain customers due to their religious or political affiliation.”

“We call on Chase to stop its religious and politically biased discrimination and start living up to its commitment to an inclusive society where everyone feels welcomed, equal, and included,” the letter stated.

“It is not our policy to debank people because of their political views or religious affiliation,” the bank’s board of directors previously said, per Fox News.