Florida Senate proposes $900 million tax relief package

TALLAHASSEE, Fla. – The Florida Senate Committee on Finance and Tax released its tax relief package for the upcoming fiscal year on Monday.

The legislation includes over $900 million in savings for families and businesses, the Senate announced.

It will additionally focus on “keeping Florida affordable by reducing taxes on property insurance as well as key items utilized by growing families and seniors.”

The bill, SPB 7074, is scheduled to be taken up during the Senate’s Finance and Tax committee meeting on Tuesday.

Multiple sales tax holidays are included in the bill, such as the back-to-school sales tax holiday, two disaster preparedness sales tax holidays, a month-long summer sales tax holiday, and a skilled worker sales tax holiday.

The proposal “builds on historic tax relief passed in prior years, which helps Floridians fight inflation,” the announcement said.

According to the bill’s analysis, it will prohibit a tourist development plan from “allocating more than 25% of the tax revenue received for a fiscal year to fund an individual project unless the governing board of the county approves the use by a supermajority vote.”

For property taxes, the bill would extend the time in which a property owner “may begin rebuilding homestead property and continue to maintain homestead property tax benefits from 3 years to 5 years.”

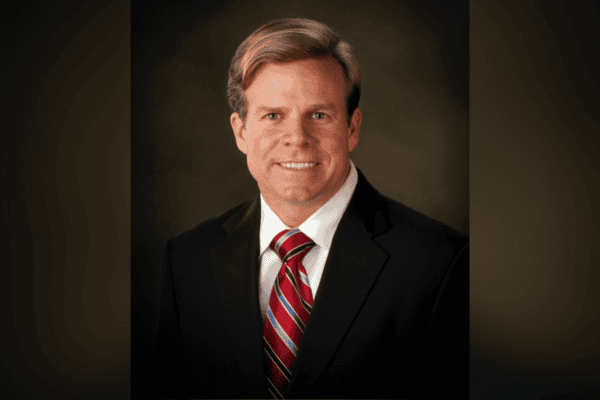

Senate Finance and Tax Committee Chair Blaise Ingoglia, R-Spring Hill, said Florida “cannot independently fix or outpace inflation caused by reckless spending policies in Washington.”

“While the federal government just keeps printing money, here in Florida under the leadership of Governor DeSantis and the Florida Legislature, we are saving it and living within our means,” Ingoglia said.

Ingoglia said the legislation “reduces the cost of doing business in Florida, lowering some of the cost associated with collecting sales tax on behalf of the state and local government.”

The bill includes a “one-year exemption on taxes, fees, and assessments for residential property insurance policyholders, covering the cost of select taxes, fees, and assessments for residential property insurance policies with a coverage amount of up to $750,000.”

The policies must be written between July 1 and June 30, 2025, for a 12-month coverage period.

A one-year insurance premium tax exemption on Flood Insurance Policies is also included in the bill.

Senate President Kathleen Passidomo, R-Naples, said lawmakers “recognize” the cost of property insurance is “posing a major affordability problem for many Florida homeowners.”

“I believe every little bit helps, and reducing the taxes associated with flood insurance and property insurance premiums is important for families who are trying make ends meet as our insurance market strengthens,” Passidomo said.

The bill will increase the annual cap for the “Strong Families Tax Credit Program” from $20 million to $40 million, the press release said.

The Strong Families Tax Credit Program was created in 2021 to “provide tax credits for businesses that make monetary donations to certain eligible charitable organizations focused on child welfare and well-being.”

If passed, the bill takes effect July 1.