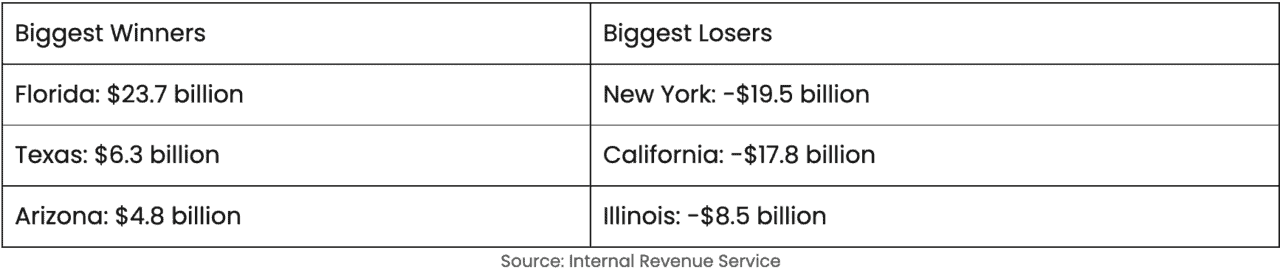

Jimmy Patronis: Democrats’ New IRS Agents Will Be ‘Targeting’ Florida, Proposes Criminal Penalties for Politically Motivated Audits

August 17, 2022 Updated 5:45 P.M. ET

TALLAHASSEE (FLV) – Chief Financial Officer Jimmy Patronis wants Florida lawmakers to approve criminal penalties for potential “politically motivated” audits after the Biden Administration approved funding for 87,000 new IRS agents.

“People are people and they’re human and they will make decisions based on their own politics,” Patronis said. “And when somebody crosses a line in the role of their job as an IRS agent and it’s politically motivated, we will create those criminal penalties.”

Patronis did not detail what those penalties would include, but said they would create a deterrent. He pointed back to when the IRS, in 2013, gave conservative groups seeking-tax exempt status extra scrutiny.

Patronis said in a Fox News interview he wants lawmakers to consider his proposals in the legislative session.

“And Washington, I’m sorry you know, they’re obsessed with the state of Florida and Ron DeSantis,” he said. “So we’re going to protect Floridians.”

‘It Was a Middle Finger to the American Public,’ DeSantis Slams 87,000 New IRS Agents

The Inflation Reduction Act includes funding for 87,000 new IRS agents.

“And I’m keeping my campaign commitment: No one — let me emphasize — no one earning less than $400,000 a year will pay a penny more in federal taxes,” Biden said in a recent speech.

Patronis’ other proposal includes requiring all state chartered banks to report any IRS engagement. He wants Florida to require licensure of all IRS agents when they enter the state. Patronis said there will be a licensing fee that will go into a trust fund. The trust fund would be used as a civil defense fund for lawsuits against the IRS for political targeting of businesses.

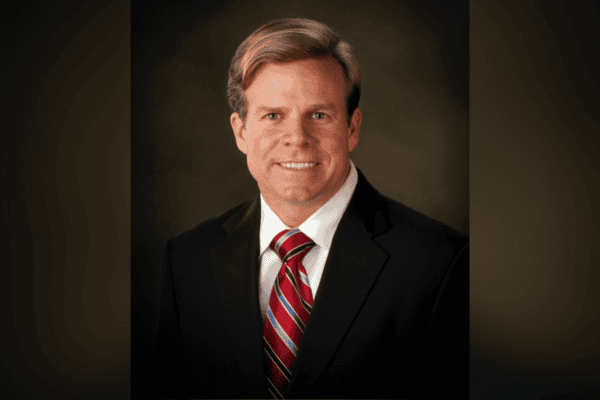

Patronis said Florida would specifically be a target because of the enormous amount of wealth settling into the state. Over just the past year, $23 billion of new annual income just last year alone has moved to the state of Florida, he said. That compares to California which lost $18 billion of annual income.

“These new IRS agents are going to go and they’re going to follow the money,” Patronis said.

Florida’s Voice previously published a story about droves of people moving to Florida because of lockdowns in blue states.

Blue State Lockdowns Caused Influx to Florida, a Large Part of the Rise in Rent Prices: ‘Folks Vote With Their Feet’

In 2020, the migration from high tax states to low tax states surged during pandemic lockdowns. Below is the breakdown of the migration of taxpayers and aggregate adjusted gross income between states in 2020: