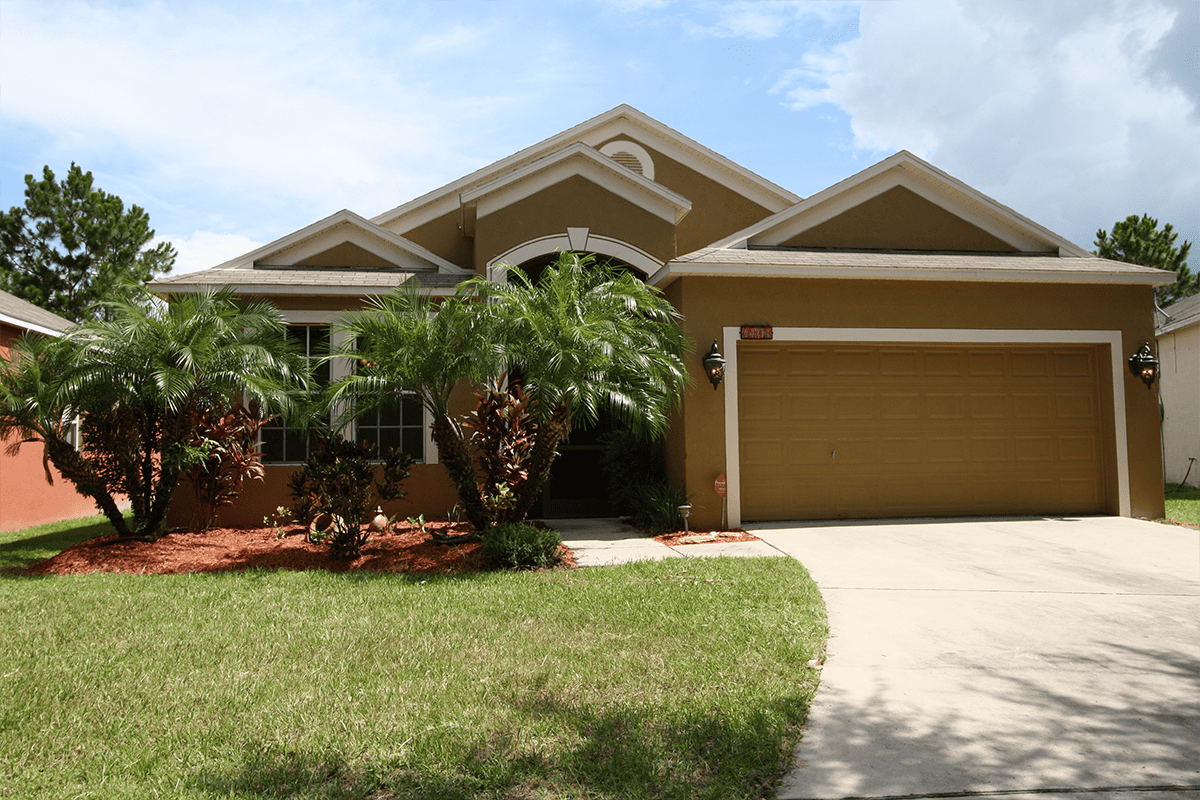

Palm Beach County will grant up to $100K to eligible first-time homebuyers

WEST PALM BEACH, Fla. – Palm Beach County announced it will grant up to $100,000 to eligible first-time homebuyers through its Housing and Economic Development program.

“Funding will assist income eligible applicants to acquire their first home (including acquisition, acquisition/rehabilitation, new construction, downpayment and closing costs) that will be used as their principal place of residence,” the department said.

Specifically, assistance is funded by the department’s HOME Investment Partnerships Program. Housing and Economic Development has allocated $4 million to the investment.

According to the department, purchased price for any property cannot eclipse $568,557. Grants will be awarded as a 0% interest deferred payment loan firmed by a recorded mortgage, promissory note and declaration of restriction for 30 years. The loan is then absolved at the end of the term.

Eligible funding is provided for those in the following categories:

Household Size (Number of Persons) – Low Income 80% (Less than or equal to)

- 1 – $54,550

- 2 – $62,350

- 3 – $70,150

- 4 – $77,900

- 5 – $84,150

- 6 – $90,400

Applicants are encouraged to apply online beginning on Oct. 10 at 8 a.m. The program will close on Oct. 31 or until 50 applications have been submitted. In addition, all applicants are required to attend one virtual mandatory orientations. Those times are listed below.

- Tuesday, Sept. 19 at 10 a.m.

- Thursday, Sept. 21 at 2 p.m.

- Tuesday, Sept. 26 at 10 a.m.

- Thursday, Sept. 28 at 2 p.m.

- Tuesday, Oct. 3 at 10 a.m.

- Thursday, Oct. 5 at 2 p.m.

- Tuesday, Oct. 10 at 10 a.m.

- Thursday, Oct. 12 at 2 p.m.

To be eligible, all adult household members are required to have a Mandatory Orientation Certificate and a pre-approval letter copy from a First Mortgage Lender.

Additional documents can include: copy of valid drivers’ license or state identification, copy of U.S. Birth Certificate or valid U.S. Passport/OR Naturalization Certificate.