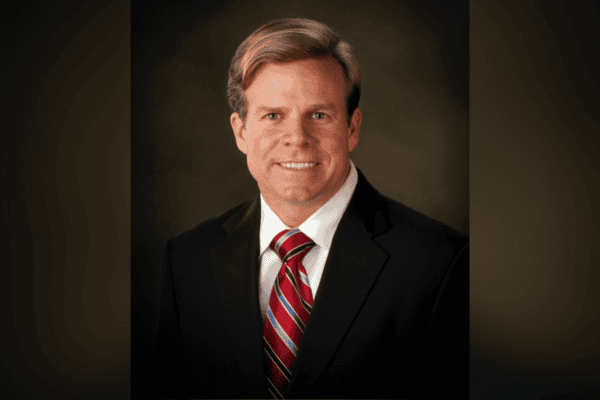

Rep. Tom Leek highlights major tax holidays coming up for Floridians

TAMPA, Fla. – Rep. Tom Leek, R-Ormond Beach, discussed the state budget and how it will help Floridians in the upcoming fiscal year during an interview on Florida’s Voice with Brendon Leslie.

Leek explained that Florida is not like the U.S. Congress when it comes to passing budgets.

“In Florida we are balanced, lean and we are on time,” he said.

“Roughly, Florida is the 15th largest economy in the world. So what we get right is, we’re open for business,” he continued. “We allow people to come to the state of Florida, have the freedom to do the things that they want to do and to be successful in business.”

Leek also touched on the tax relief package that is included in the budget, totaling roughly $1 billion in savings for Floridians through tax holidays, exemptions and credits.

“What we focused on this year for the tax package is we wanted things that would go back to the consumer directly,” he said, highlighting the Freedom Fest, back-to-school and hurricane preparedness tax holiday.

“The things we thought would go directly into the pockets of consumers is where we focused the tax package this year,” he said.

Leek explained that when deciding where funds and resources should be allocated, he wants to make each dollar benefit the most people possible.

“I’m not interested in naming peoples’ libraries. I’m interested in underground utilities, I’m interested in roadways, I’m interested in those things that are going to have the largest public benefit,” he said.

The representative additionally spoke on the domestic security funding the budget allocates for the state guard to combat illegal immigration into Florida.

“If you look at what’s happening in Haiti now and you look at this illegal immigration coming in through Haiti, that money and the money that we gave to the state guard is going to be directly impactful on keeping those illegal immigrants out of the state of Florida,” he said.

Leek expects Gov. Ron DeSantis to use his line item veto power to slash certain aspects of the state budget before it is signed into law.

Below is a list of the major tax holidays Floridians can expect, should DeSantis sign off on them:

- Back-to-schoolsales tax holiday: This would last 14 days, from July 29, Aug. 11. It applies to the following:

- Clothing, footwear, and backpacks costing $100 or less

- School supplies costing $50 or less

- Learning aids costing $30 or less

- Personal computers or computer accessories, and software, costing $1,500 or less

- Disaster preparedness sales tax holiday: This would last for 14 days, twice during hurricane season, from June 1-14, and Aug. 24-Sep. 6. Hurricane season runs June 1 to Nov. 1. Below are items that would apply:

- Flashlights and lanterns $40 or less

- Reusable ice $20 or less

- Radios $50 or less

- Tarps, ground anchors, tie-down kits $100 or less

- Coolers, portable power banks $60 or less

- Batteries, fuel tanks $50 or less

- Smoke detectors, fire extinguishers, carbon monoxide detectors $70 or less

- Generators $3,000 or less

- Additional items related to evacuating pets

- “Freedom Month” summer sales tax holiday: This would run from July 1-31. The below items would apply:

- Admissions to music, sporting, cultural events

- Tickets to movies, museums

- Tickets to theater and dance performances

- State park passes

- Use of fitness facilities

- Water and boating equipment and supplies

- Camping products

- Fishing products

- Electric scooters

- Outdoor supplies like sunglasses, sunscreen, grills, pool chemicals, supplies and parts

- “Skilled worker” tools sales tax holiday: This would run from Sep. 1-7. The below items would apply:

- Hand tools $50 or less

- Power tools $300 or less

- Work boots $175 or less

- Other safety equipment

- Shop lights, toolboxes, belts

- Plumbing, electric equipment

- Toll relief: Lawmakers decided to continue providing toll relief, this coming year to the tune of at least $450 million.

- Applies to certain “high-use” customers from April 2024 to March 2025

- Those eligible must engage in 35 or more toll transactions per month, and they would receive a 50% credit in return

- Property insurance relief: Lawmakers passed legislation giving one year of relief for residential property insurance holders. The cost of the insurance premium tax is covered.

- On top of that, one year was given for relief on the insurance premium tax for flood insurance policies.

- Both applies to policies written between Oct. 1, 2024 and Sept. 30, 2025.

- Hillsborough County sales tax holiday: Applying only to Hillsborough, lawmakers approved $182 million in local sales tax relief for Hillsborough thanks to a court ruling on the formerly in place county transportation tax.