Florida CFO Patronis Divests Billions from BlackRock, Slams ‘Social-Engineering Project’ and ESG

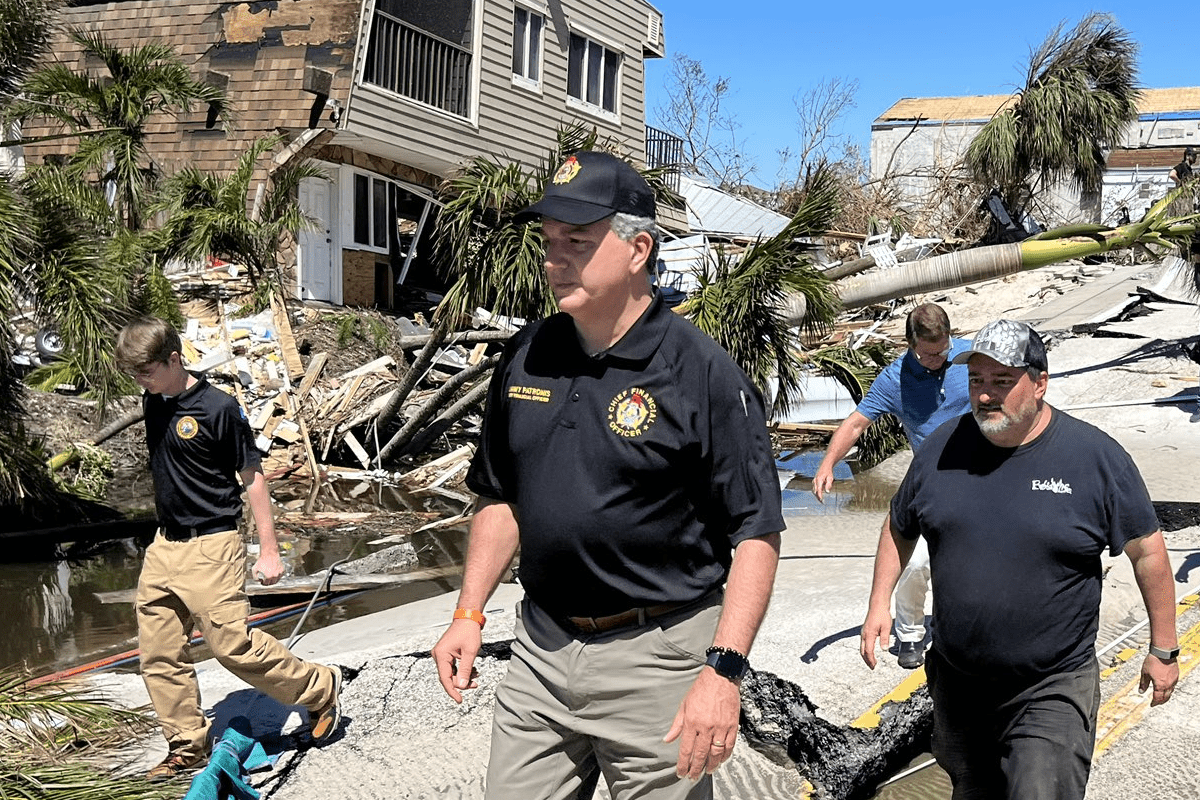

TALLAHASSEE (FLV) – Florida Chief Financial Officer Jimmy Patronis announced the Treasury is divesting billions in taxpayer funds from investment management firm BlackRock.

Patronis’ office said $2 billion worth of assets would be divested from the financial giant.

$1.43 billion of long-term securities will be frozen and BlackRock will be removed as manager of ~$600 million in short-term investments. The money comes from Florida’s Treasury Investment Pool.

The Department of Financial Services said the Treasury will have divested all of their short- and long-term investments, shifting them to other fund management entities, by the beginning 2023.

Patronis said he does not trust BlackRock’s “ability to deliver.”

“As Florida’s Chief Financial Officer, it’s my responsibility to get the best returns possible for taxpayers. The more effective we are in investing dollars to generate a return, the more effective we’ll be in funding priorities like schools, hospitals and roads,” he said. “As major banking institutions and economists predict a recession in the coming year, and as the Fed increases interest rates to combat the inflation crisis, I need partners within the financial services industry who are as committed to the bottom line as we are – and I don’t trust BlackRock’s ability to deliver.”

The CFO went on to argue CEO Larry Fink is “on a campaign to change the world,” citing an open letter to CEOs championing ‘stakeholder capitalism,’ which Patronis said leads towards leaning on ESG scores.

“To meet this end, the asset management company has leaned heavily into Environmental, Social, and Governance standards – known as ESG – to help police who should, and who should not gain access to capital,” he continued. “Whether stakeholder capitalism, or ESG standards, are being pushed by BlackRock for ideological reasons, or to develop social credit ratings, the effect is to avoid dealing with the messiness of democracy. I think it’s undemocratic of major asset managers to use their power to influence societal outcomes. If Larry, or his friends on Wall Street, want to change the world – run for office. Start a non-profit. Donate to the causes you care about.”

Florida’s CFO said Florida did not “sign up” for BlackRock to use taxpayer funds to promote their “social-engineering project.”

“It’s got nothing to do with maximizing returns and is the opposite of what an asset manager is paid to do. Florida’s Treasury Division is divesting from BlackRock because they have openly stated they’ve got other goals than producing returns,” he went on.

“As Larry Fink stated to CEOs ‘[A]ccess to capital is not a right. It is a privilege.’ As Florida’s CFO I agree wholeheartedly, so we’ll be taking Larry up on his offer. There’s no lack of companies who will invest on our behalf, so the Florida Treasury will be taking its business elsewhere.”

The Department said BlackRock managed the state’s $600 million Short Term Investment Fund, which is now to be totally divested. They also managed $1.43 billion of Florida’s Long Duration Portfolio.

Overall, $60 billion in taxpayer money is managed by the Department.

ESG has come under fire among Florida leadership in 2022. Over the summer, Gov. Ron DeSantis called for U.S. states to launch war on ESG to “keep power to the people.”

The criteria rates companies based on factors like how the company addresses climate change and its relationships with employees. DeSantis said this criteria is used to target “disfavored” individuals and industries to advance a “woke” ideological agenda.

“And I think our economy is going to be much better off if everything is not politicized. It used to be it wasn’t a political issue. You didn’t have to take positions on every little thing,” DeSantis said.

In August, Florida barred ‘woke’ investment of state funds and continued the crackdown on ESG.

“I think the movement that we’ve seen to harness economic power to try to advance an ideological agenda that doesn’t have enough appeal to win at the ballot box is something that is very significant,” he said.

Under the resolution, Florida’s fund managers will be required to invest state funds in a way that prioritizes the highest return on investment for Florida taxpayers instead of considering political factors. ESG factors will not be part of the Florida’s pension investment management practices.

Late November, new Florida House Speaker Paul Renner vowed the legislature will continue targeting ESG and demanded credit rating agencies “drop the politics.”

“In practice, ESG demands that companies adopt radical environmental and diversity goals and uses a scoring system to reward or punish companies based on their compliance,” Renner said. “These radical goals are causing a politically-induced energy crisis, raising prices at the pump and our electric bills. ESG increases our cost of living, undermines our national security, and bypasses the checks and balances of the democratic process.”

Renner said credit rating agencies began requiring the state provide data to measure compliance with “ESG’s political dogma”: “ESG scoring will soon become a factor in our state’s credit rating, meaning fiscally irresponsible states like California could receive a better credit rating than Florida simply because they embrace ESG’s political agenda.”